Trump Reciprocal Tariff: Impact on Indian Sectors

U.S. President Donald Trump, despite referring to Prime Minister Narendra Modi as a good friend, has said the tariffs imposed by India on U.S. goods, calling them unfair. In response, he has proposed reciprocal tariffs on India — mirroring the duties India imposes on American goods.

This isn’t just about India. Other countries with trade surpluses against the U.S. are also likely to feel the pressure.

Trump highlighted how countries like South Korea and Japan retain most of their production for domestic car consumption — 80% and 90%, respectively. He questioned why the U.S. should not adopt a similar “local-first” approach in global trade.

Given that the U.S. is one of the largest contributors to global trade, such tariff decisions signal a shift towards deglobalization and raise the specter of a broader trade war.

How Much Is at Stake for India?

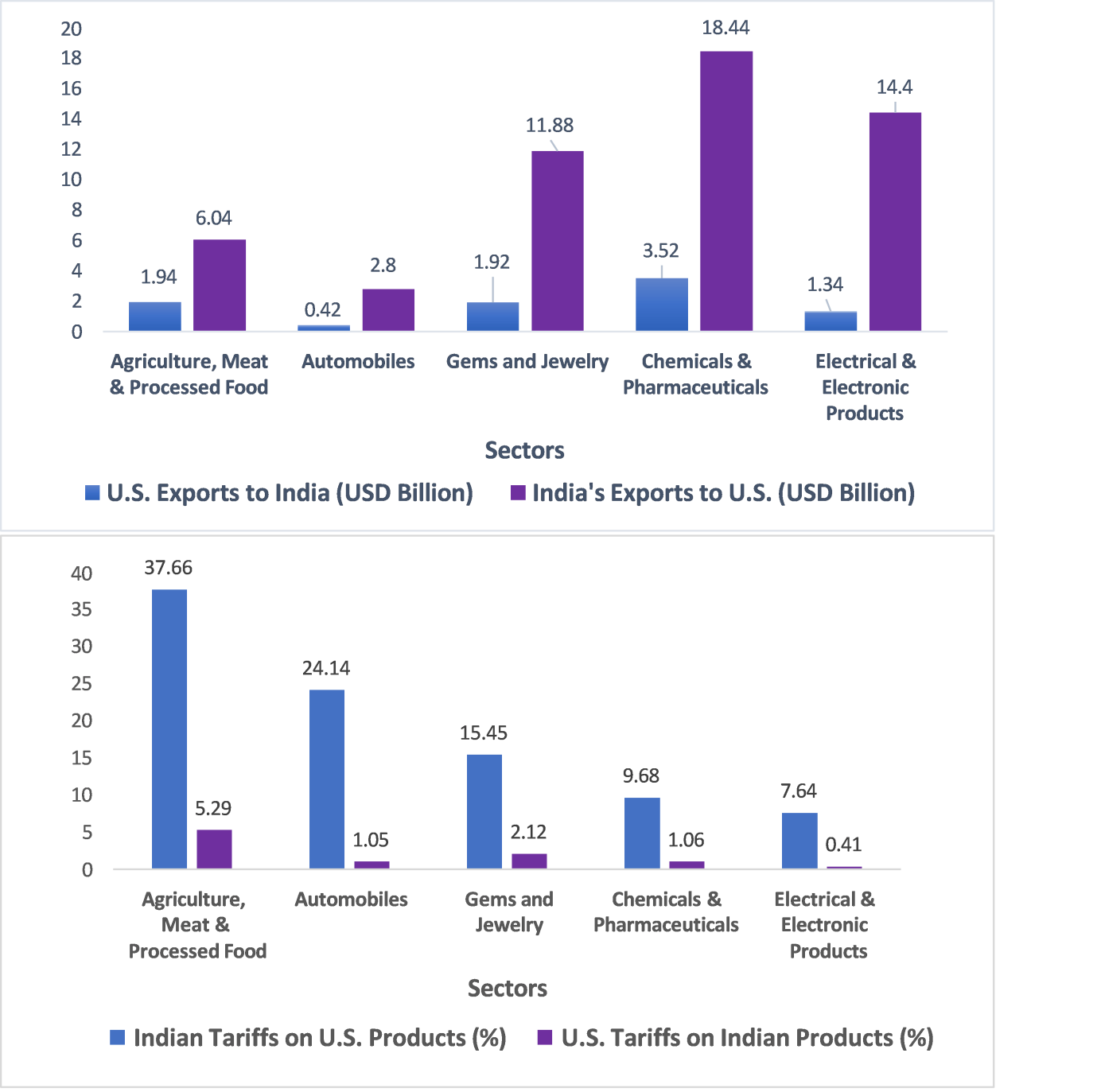

- India exported $77.5 billion worth of goods to the U.S. in FY24 — just 2.17% of India’s GDP.

- However, only 1.1% of India’s GDP is tied to sectors vulnerable to U.S. tariffs.

- Key exports like pharmaceuticals, auto parts, and electronics are likely to remain resilient.

- Gems & jewellery and apparel may face headwinds, as they rely heavily on U.S. demand.

The US-India Trade Journey

- FY2000: The U.S. accounted for 23% of India’s exports.

- FY2011: Dropped to 10%.

- FY2025TD: Climbed back to 19%.

Though the U.S. remains India’s largest export destination, India’s trade portfolio is now more diversified, reducing over-reliance on any one partner.

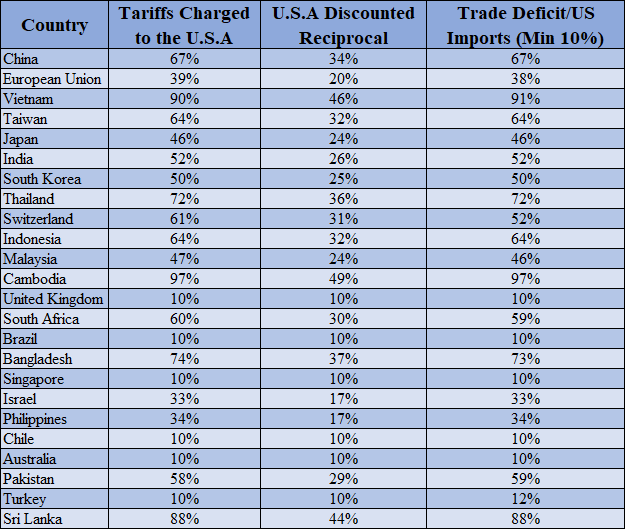

Different Countries Tariff’s Deficit:

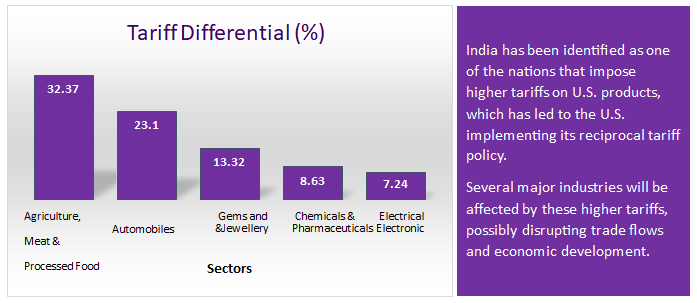

India's Tariff Landscape and Impacted Sectors

India's Tariff Landscape: Sectoral Impact Assessment

Low-Risk Sectors

- Pharmaceuticals: As a leading global supplier, this sector remains largely unaffected and might see positive momentum.

- Electronics & Auto Parts: Strong domestic demand and a diverse export base make these sectors resilient despite potential tariffs.

High-Risk Sectors

- Gems & Jewellery: The U.S. is a major consumer. Higher tariffs could significantly reduce demand.

- Apparel & Textiles: Already facing tough competition from Vietnam and Bangladesh, new tariffs may further erode India’s market share.

Conclusion: Navigating the Tariff Headwinds

While the imposition of reciprocal tariffs by the U.S. introduces an element of uncertainty into India–U.S. trade relations, the macro-level impact on India’s economy remains limited. Only a small portion of GDP is directly exposed to the affected sectors.

India’s diversified export structure, robust domestic consumption, and globally competitive sectors like pharmaceuticals and IT services provide a strong buffer. In the near term, market volatility and sector-specific reactions are expected, but systemic risk remains low.

Investors are suggested to remain cautious but not reactive. A strategic, long-term view—backed by diversification through asset allocation will be key to navigating this evolving global trade environment.

Research Credits: Subhash, Nikitha & Dhanya

- Apr 7, 2025

Family Office | Estate Planning | Tax Services | ESOP Advisory | Company Incorporations | Mutual Funds | PMS | Bonds | AIF | Offshore Investing | Private Equity and Venture Capital Funds

Disclaimer: All the above views are for educational purposes and are not given as investment advice.

Subscribe To Our Blogs

About Author

Sri Subhash Yerneni

Sri Subhash is an astute banking and finance professional with 14 years of real-world experience in wealth management, advisory of financial instruments such as mutual funds-equity and debt-alternate investment funds ( AIF)-structure and offshore products-private equity-venture capital/debt-bonds and MLDs-priority banking-cash management-team management-and working with various cultures in various nations.

Recent Blogs

Quick Links

Services

Services

Contact Info

3rd Floor, Plot No. 55/A, Rd No 52, BNR Hills, Jubilee Hills, Rai Durg, Hyderabad - 500081

Copyright © 2025 VIKA WEALTH – All Rights Reserved.

Quick Links

Services

Contact Info

3rd Floor, Plot No. 55/A, Rd No 52, BNR Hills, Jubilee Hills, Rai Durg, Hyderabad - 500081

Copyright © 2025 VIKA WEALTH – All Rights Reserved.