Maximize Your Property Sale: Tax Strategy That Works

• Property sold for: ₹5 Cr

• Purchased in FY 2015–16 for: ₹2 Cr

• Indexed Cost (CII based): ₹2.74 Cr

• LTCG:₹2.26 Cr

• LTCG Tax (@20.8%): ₹47.0 lakhs

• Net amount after tax: ₹5 Cr − ₹47L = ₹4.53 Cr (rounded to ₹4.6 Cr for simplicity)

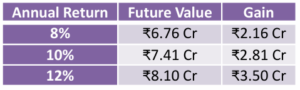

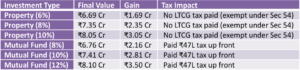

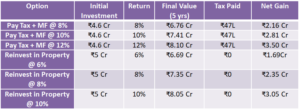

SCENARIO A: Pay Capital Gains Tax & Invest ₹4.6 Cr in Mutual Funds

Future Value at different returns (8%, 10%, 12%) over 5 years

Note: LTCG on mutual fund gains above ₹1 lakh is taxed at 10% (excluding indexation).

SCENARIO B: Don’t Pay Capital Gains Tax — Reinvest Entire ₹5 Cr in a Property

(Section 54)

Let’s assume:

• Entire ₹5 Cr invested in residential real estate

• Growth rate: 6%, 8% and10% CAGR

• Holding period: 5 years

Summary Table

Note: All the returns are taken as post tax.

Property values include rental income if any +plus capital gain.

Conclusion: We believe that paying capital gains tax and investing the net proceeds in mutual funds offers a significantly better risk-reward profile than reinvesting in property purely for the purpose of saving tax.

Mutual funds provide key advantages like:

- Liquidity – assets can be sold anytime without long waiting periods

- No legal or title-related hassles – unlike real estate

- No maintenance or tenant issues – making it stress-free

- Diversified exposure and professional management – improving overall efficiency

While real estate is illiquid and comes with operational and compliance burdens, mutual fund investments can be tracked daily and tailored to your risk profile. With a disciplined approach and a well-planned strategy, mutual funds are a superior choice — especially with a 5-year investment horizon. It also depends upon the age of the investor. This is not a one fit all solution.

In our view, if one can manage short-term emotional volatility and focus on long-term goals, mutual funds clearly emerge as the more efficient, flexible, and rewarding option.

- Apr 25, 2025

Family Office | Estate Planning | Tax Services | ESOP Advisory | Company Incorporations | Mutual Funds | PMS | Bonds | AIF | Offshore Investing | Private Equity and Venture Capital Funds

Disclaimer: All the above views are for educational purposes and are not given as investment advice.

Subscribe To Our Blogs

About Author

Sri Subhash Yerneni

Sri Subhash is an astute banking and finance professional with 14 years of real-world experience in wealth management, advisory of financial instruments such as mutual funds-equity and debt-alternate investment funds ( AIF)-structure and offshore products-private equity-venture capital/debt-bonds and MLDs-priority banking-cash management-team management-and working with various cultures in various nations.

Recent Blogs

Quick Links

Services

Services

Contact Info

3rd Floor, Plot No. 55/A, Rd No 52, BNR Hills, Jubilee Hills, Rai Durg, Hyderabad - 500081

Copyright © 2025 VIKA WEALTH – All Rights Reserved.

Quick Links

Services

Contact Info

3rd Floor, Plot No. 55/A, Rd No 52, BNR Hills, Jubilee Hills, Rai Durg, Hyderabad - 500081

Copyright © 2025 VIKA WEALTH – All Rights Reserved.