Large Cap Investing: Active vs Passive – What Truly Wins?

A common belief in the investment world is that passive funds are the superior choice when it comes to large cap investing. The logic is straightforward: lower costs and efficient markets should mean passive wins.

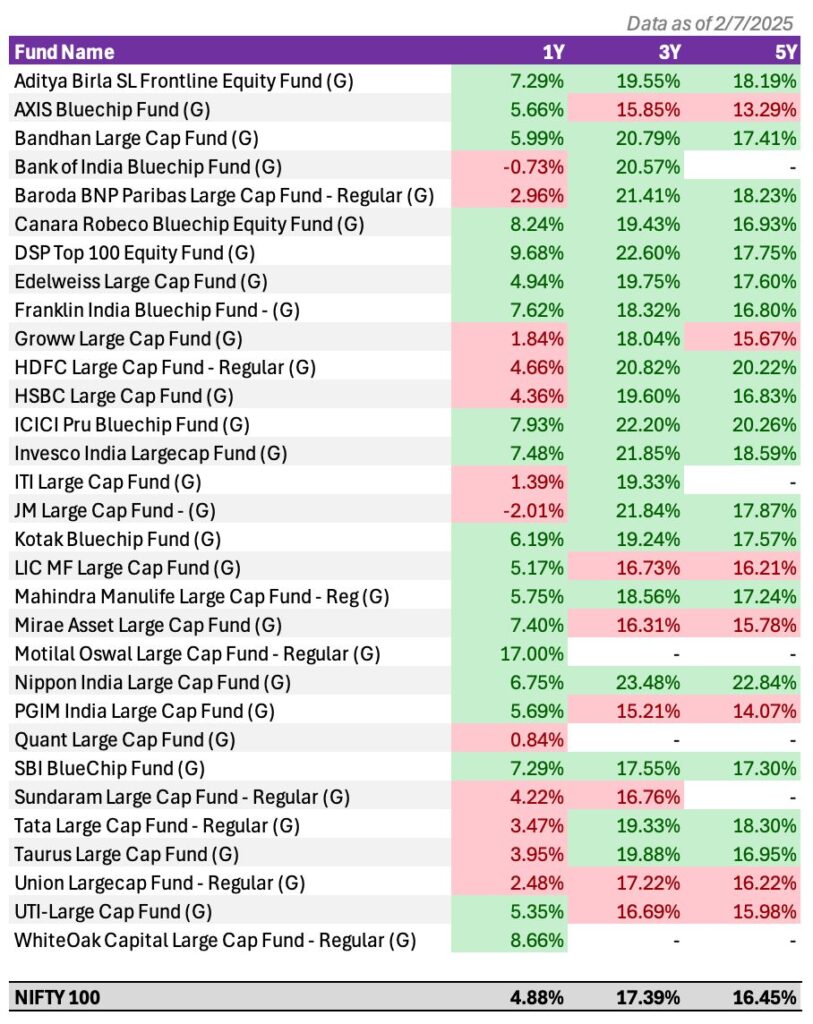

But our analysis of rolling returns over the past 1, 3, and 5 years paints a different picture.

It is not just about costs. Many active large cap funds have consistently outperformed the Nifty 100, their benchmark index. The green-highlighted cells in our analysis mark instances where fund returns exceeded the index – and these are far from rare.

This reinforces a key insight: choosing the right fund manager matters. With skill, discipline, and a proven process, active management can add real value – even in a space as closely watched as large caps.

Key Insights:

- Over a 5-year period, 17 out of 25 funds (where data is available) outperformed the Nifty 100 return of 16.45%.

- Over 3 years, 20 out of 29 funds beat the Nifty 100’s 17.39% return.

- Even on a 1-year basis, 18 out of 30 funds outperformed the benchmark’s 4.88% return.

Top Performers Across Timeframes:

- Nippon India Large Cap Fund: 23.48% (3Y), 22.84% (5Y)

- ICICI Pru Bluechip Fund: 22.20% (3Y), 20.26% (5Y)

- HDFC Large Cap Fund: 20.82% (3Y), 20.22% (5Y)

- Motilal Oswal Large Cap Fund: 17.00% (1Y) – standout recent performer

Conclusion:

- Outperformance is not accidental. A skilled fund manager, with the ability to allocate across sectors and stocks wisely, can deliver alpha – even in efficient, large cap markets.

- Cost is important, but not the only factor. The added value from stock-picking and sector allocation can outweigh the passive fee advantage.

Research Credits: Vishnu Mallipudi

Best Regards

Sri Subhash Yerneni,

Founder,

Vika Wealth.

- July 4, 2025

Family Office | Estate Planning | Tax Services | ESOP Advisory | Company Incorporations | Mutual Funds | PMS | Bonds | AIF | Offshore Investing | Private Equity and Venture Capital Funds

Disclaimer: All the above views are for educational purposes and are not given as investment advice.

Subscribe To Our Blogs

About Author

Sri Subhash Yerneni

Sri Subhash is an astute banking and finance professional with 14 years of real-world experience in wealth management, advisory of financial instruments such as mutual funds-equity and debt-alternate investment funds ( AIF)-structure and offshore products-private equity-venture capital/debt-bonds and MLDs-priority banking-cash management-team management-and working with various cultures in various nations.

Recent Blogs

Quick Links

Services

Services

Contact Info

3rd Floor, Plot No. 55/A, Rd No 52, BNR Hills, Jubilee Hills, Rai Durg, Hyderabad - 500081

Copyright © 2025 VIKA WEALTH – All Rights Reserved.

Quick Links

Services

Contact Info

3rd Floor, Plot No. 55/A, Rd No 52, BNR Hills, Jubilee Hills, Rai Durg, Hyderabad - 500081

Copyright © 2025 VIKA WEALTH – All Rights Reserved.