The Case for Silver: Why It’s a Smart Investment Today

What is Silver?

Silver is a precious metal, widely known for its beautiful appearance, high usefulness in industries, and its role as a traditional store of wealth. One of silver’s biggest advantages is that it is highly versatile, meaning it can be used for many different purposes across industries. Here are some of silver’s key properties that make it useful:

Excellent Electrical Conductivity: Silver is the best conductor of electricity among all metals. This is why it is used in wires, circuits, mobile phones, and other electronic items. Useful in products like solar panels and electrical equipment.

Malleability and Ductility: Silver can be easily shaped, stretched, or flattened into thin sheets or wires without breaking. This makes silver ideal for making jewellery, coins, and delicate industrial components.

Antibacterial Properties: Silver naturally kills germs and bacteria, which is why it is used in medical devices, surgical instruments, and even coatings for hospital equipment.

Resistance to Corrosion: Unlike metals like iron, silver does not rust or get damaged easily, which increases its durability.

Silver as a Store of Value

Apart from industrial uses, silver has been used for centuries as a form of wealth preservation in the form of:

- Coins and bars

- Jewellery and utensils

- Investment products like Silver ETFs and futures contracts

Silver as an Investment Opportunity

- Limited Supply: Silver is a naturally limited resource, which makes it scarce and valuable over time. In 2024, global silver demand was around 1.22 billion ounces, while supply was only 1.07 billion ounces, showing a clear gap between demand and availability.

- Hedge Against Inflation: Historically, investors have turned to silver to preserve their wealth during periods of rising inflation or currency depreciation. One important indicator is the Gold-to-Silver ratio, which currently stands at 90:1, significantly higher than its 10-year average of approximately 56:1 suggesting that silver is relatively undervalued compared to gold.

- Physical Asset: Unlike digital or paper-based financial assets, physical silver can be held directly by investors, providing a tangible form of wealth.

- High Liquidity: Silver can be easily bought or sold globally in the form of jewellery, coins, bars, or through investments like ETFs.

- Historical Track Record: Silver has been used as money, a medium of exchange, and a store of wealth.

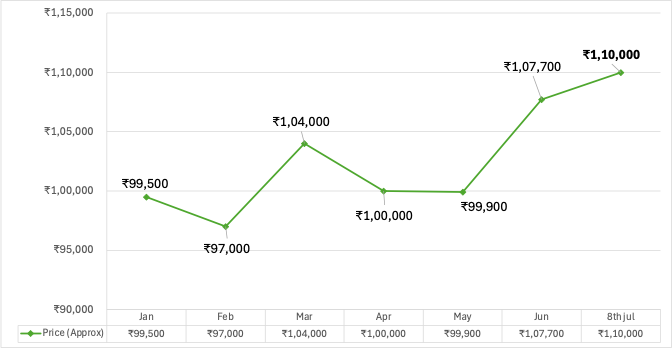

Silver Price Trends (₹/kg) – 2025

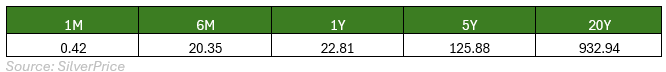

Silver Returns (%)

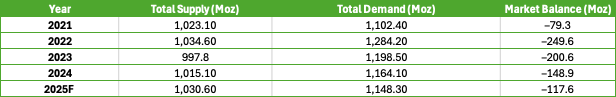

Silver Supply & Demand Snapshot

Source: SilverInstitute, GoodReturns

Source: SilverInstitute, GoodReturns

Factors Influencing Silver Prices

- Industrial Demand

Silver is widely used in sectors such as:

- Electronics

- Solar Photovoltaics

- Electric Vehicles (EVs)

- Medical Devices

The rise in clean energy initiatives, EV production, and technological advancements directly contributes to increased silver demand. Industrial demand accounted for approximately 55–60% of total global silver consumption in recent years.

- Supply Constraints

Silver supply primarily comes from:

- Mine production, which has remained stagnant or seen only marginal growth.

- Recycling, which provides secondary supply but has not compensated for rising demand.

- Global mine production in 2024 stood at approximately 819 million ounces, below total demand levels.

- Top silver producing countries in 2023-2024:

Source: SilverInstitute

Source: SilverInstitute

- Investment and Safe-Haven Demand

During times of economic uncertainty or inflation, investors often turn to silver as a safe-haven asset. Key forms of investment include:

- Physical silver bars and coins

- Exchange-Traded Funds (ETFs)

- Futures contracts

- Macroeconomic Factors

- Weakening US Dollar: When the US dollar weakens, silver becomes cheaper for buyers globally, often leading to increased demand and higher prices.

- Inflation: Rising inflation encourages investors to seek assets like Silver.

- Lower interest rates: Investors will seek other investment avenues that offer higher returns, such as precious metals, junk bonds, etc.

- Economic Slowdowns

May reduce industrial demand for silver in sectors like electronics or automotive.

- Geopolitical Events

Geopolitical events such as armed conflicts, trade tensions, and political instability often influence silver prices owing to increasing uncertainty and investors drawn towards safe-haven assets like precious metals. - Mining and Production Disruptions

Silver production can be impacted by:

- Labor strikes

- Environmental regulations

- Exploration challenges

- Technological limitations

Recent Developments

The silver market has witnessed significant activity over the past year, driven by a combination of industrial demand, supply constraints, and macroeconomic trends:

- Record Prices in India:

Silver prices crossed the ₹1,00,000 per kg mark for the first time in May 2025, and further touched record highs of approximately ₹1,12,000 per kg on the Multi Commodity Exchange (MCX) in June 2025.

- Global Price Surge:

International silver futures on the COMEX reached approximately $35.82 per ounce in June 2025, marking a 13-year high, supported by industrial demand and safe-haven buying.

- Persistent Supply Deficit:

According to the World Silver Survey 2025, the global silver market remains in a notable supply deficit for the third consecutive year, driven by record-high industrial consumption and constrained mine production.

- Rising ETF Participation:

ETFs provide exposure to silver prices without the need to physically hold the metal. It eliminates storage concerns, insurance costs, and purity verification issues linked with physical silver. ETFs offers greater liquidity as investors can buy or sell easily through stock exchanges.

ETFs also allow investment in small quantities, making it accessible for retail investors.

Research Credits: Navya Gaddam

Best Regards

Sri Subhash Yerneni,

Founder,

Vika Wealth.

- July 9, 2025

Family Office | Estate Planning | Tax Services | ESOP Advisory | Company Incorporations | Mutual Funds | PMS | Bonds | AIF | Offshore Investing | Private Equity and Venture Capital Funds

Disclaimer: All the above views are for educational purposes and are not given as investment advice.

Subscribe To Our Blogs

About Author

Sri Subhash Yerneni

Sri Subhash is an astute banking and finance professional with 14 years of real-world experience in wealth management, advisory of financial instruments such as mutual funds-equity and debt-alternate investment funds ( AIF)-structure and offshore products-private equity-venture capital/debt-bonds and MLDs-priority banking-cash management-team management-and working with various cultures in various nations.

Recent Blogs

Quick Links

Services

Services

Contact Info

3rd Floor, Plot No. 55/A, Rd No 52, BNR Hills, Jubilee Hills, Rai Durg, Hyderabad - 500081

Copyright © 2025 VIKA WEALTH – All Rights Reserved.

Quick Links

Services

Contact Info

3rd Floor, Plot No. 55/A, Rd No 52, BNR Hills, Jubilee Hills, Rai Durg, Hyderabad - 500081

Copyright © 2025 VIKA WEALTH – All Rights Reserved.