Is Buying a Home a Good Investment?

“I’m investing in a home.”

“A home is the best investment you can make.”

These are statements we often hear around us, and many people strongly believe them. Let’s dive into the numbers and see how residential real estate actually stacks up against the equity markets from an investment standpoint.

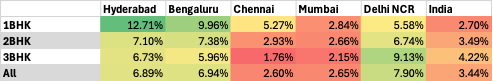

Historical Returns: Real Estate Performance

To evaluate the investment performance of residential property, we analysed data from the Housing Price Index for the period January 2017 to March 2025. This period captures various market conditions, offering a realistic perspective on long-term property appreciation across major Indian cities.

Source: Housing Price Index and Internal Research

Source: Housing Price Index and Internal Research

Across cities and property sizes, the results are mixed:

Hyderabad, Bengaluru, and Delhi NCR showed stronger appreciation compared to other metros and the national average.

Among all categories, 1BHK units in Hyderabad delivered the highest return, over 12% CAGR.

However, many other cities and property types delivered modest returns, typically below 8% CAGR.

Even after accounting for an average rental yield of 5%, only a few property categories managed to match or slightly beat index returns. In most cases, mutual fund and stock market investments have offered better returns than residential real estate.

In some cases, when the investment opportunities and timing works out in real estate, there may be significant outperformance leading to a bump up in alpha.

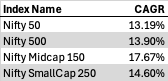

Benchmarking Against Market Indices

When compared with the performance of key Nifty indices over the same period (Jan 2017 – Mar 2025), a clear trend emerges:

Equity markets significantly outperformed residential real estate.

The Hidden Challenges of Real Estate Investing

Aside from lower returns, real estate comes with structural disadvantages that can impact overall investment performance:

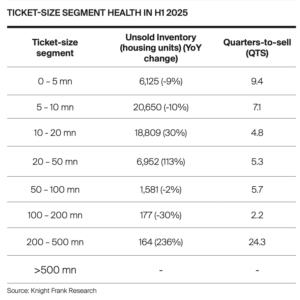

Illiquidity

Real estate is inherently illiquid.

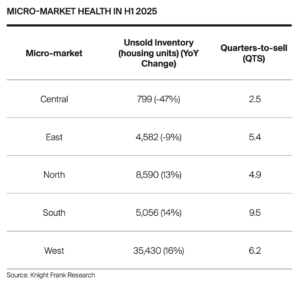

In cities like Hyderabad, the average time to sale is over 8 quarters (2 years).

A property sale can take months or even years, especially when waiting for the “right” buyer or price.

Vacancy Risk

Finding tenants can also take time, resulting in periods of no rental income, which reduces overall yield.

Registration, maintenance, brokerage, and other holding costs can further erode returns.

Emergency Access to Funds

A house cannot be partially liquidated.

In contrast, mutual funds and stocks can typically be liquidated with T+2 day settlement, making them much more flexible in urgent situations.

The Emotional Factor

We understand the emotional value and psychological comfort that comes with owning a home. It provides stability, a sense of achievement, and tangible security.

However, if the primary goal is investment and wealth creation, it is critical to view real estate objectively, not emotionally.

Conclusion

Buy a home to live in, not necessarily as an investment.

Having said that, as a diversification mechanism, up to 20% of your entire portfolio could be allocated to real estate, to gain the uncorrelated returns from the financial market. For those seeking long-term capital appreciation and liquidity, financial markets – through mutual funds and equity – offer more lucrative and efficient avenues.

Research Credits: Vishnu Mallipudi

Best Regards

Sri Subhash Yerneni,

Founder,

Vika Wealth.

- July 15, 2025

Family Office | Estate Planning | Tax Services | ESOP Advisory | Company Incorporations | Mutual Funds | PMS | Bonds | AIF | Offshore Investing | Private Equity and Venture Capital Funds

Disclaimer: All the above views are for educational purposes and are not given as investment advice.

Subscribe To Our Blogs

About Author

Sri Subhash Yerneni

Sri Subhash is an astute banking and finance professional with 14 years of real-world experience in wealth management, advisory of financial instruments such as mutual funds-equity and debt-alternate investment funds ( AIF)-structure and offshore products-private equity-venture capital/debt-bonds and MLDs-priority banking-cash management-team management-and working with various cultures in various nations.

Recent Blogs

Quick Links

Services

Services

Contact Info

3rd Floor, Plot No. 55/A, Rd No 52, BNR Hills, Jubilee Hills, Rai Durg, Hyderabad - 500081

Copyright © 2025 VIKA WEALTH – All Rights Reserved.

Quick Links

Services

Contact Info

3rd Floor, Plot No. 55/A, Rd No 52, BNR Hills, Jubilee Hills, Rai Durg, Hyderabad - 500081

Copyright © 2025 VIKA WEALTH – All Rights Reserved.