Mutual Fund Investing: Direct vs. Regular

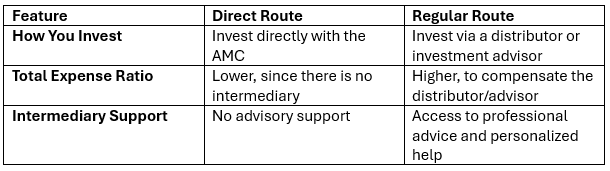

When investing in mutual funds, one of the first decisions investors face is whether to choose the Direct or Regular route. While Direct funds appear more appealing due to their lower fees, the choice is not always straightforward.

Direct vs. Regular Funds: Key Differences

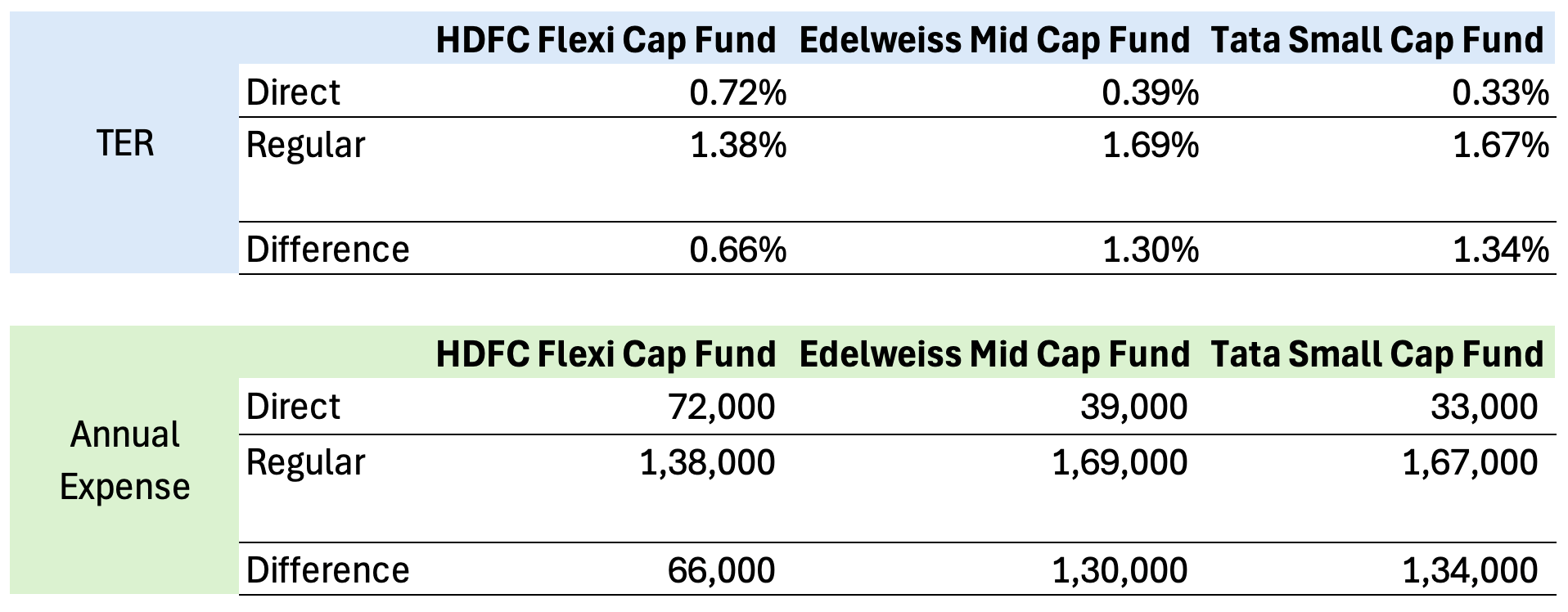

The Cost Factor: Understanding Expense Ratios

Direct funds have a noticeably lower Total Expense Ratio (TER) compared to regular funds. In some funds, the difference exceeds 1%. The table below shows the TER and annual expenses for three different funds, assuming an investment of 1 crore each.

While lower fees are important, cost is not the only consideration when evaluating these routes.

Why Work With an Intermediary?

The mutual fund universe in India is vast:

- Over 2,500 mutual fund schemes

- More than 35 distinct categories

- Offered by 45+ Fund Houses/AMCs

Navigating this complexity and identifying funds that align with your goals is a challenge. An intermediary – such as a mutual fund distributor or investment manager – can add value in many ways:

- Fund Selection: Helps you avoid the common trap of relying solely on past returns, which are unpredictable and subject to change.

- Personalized Asset Allocation:Creates a portfolio that matches your risk tolerance and long-term objectives. Tactical calls can add alpha to the portfolio.

- For instance, our calls in the recent past on banking, pharma, IT and gold have added significant alpha to client portfolios.

- Expertise: Brings deep knowledge of fund strategies, manager philosophies, risk management mechanisms and current market conditions.

- Emotional Management: Clear guidance on what to buy, how much, and when to sell for optimal portfolio performance, without being influenced by external factors like media, news and tips from friends.

- We, at Vika Wealth, stick to our proprietary framework in taking these calls and remain disciplined without wavering.

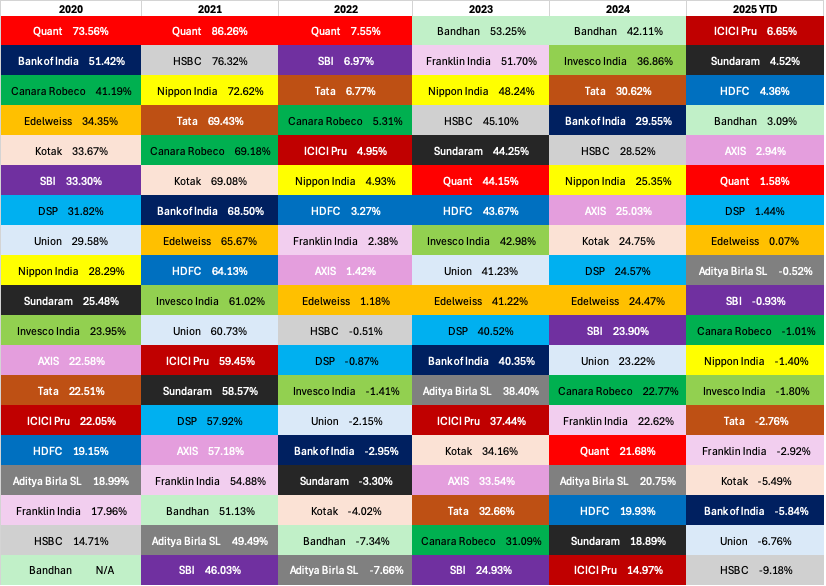

Historical Performance: Small Cap Funds

Fund performance rankings, especially among small cap funds, rotate frequently. Outperformers one year may lag behind in subsequent years, making it risky to select funds based purely on recent results.

The chart below shows the performance of small cap funds over the past 5 years.

Source: Moneycontrol.com and NGEN, Data as of 15th July, 2025

Source: Moneycontrol.com and NGEN, Data as of 15th July, 2025

Balancing Cost and Value

Going with the Regular route means paying higher annual fees, but it comes with access to disciplined portfolio management and professional advice and insights. For many investors, lacking the time and/or expertise for ongoing research, or needing personalized strategies – this guidance can justify the cost.

However, if you are confident in your ability to evaluate funds, understand your financial goals, and construct a suitable portfolio, the Direct route can help lower your investing costs and enhance returns over the years.

At Vika Wealth, we offer personalized financial solutions beyond investing—including will writing, estate planning, home buy vs. rent advice, and planning for ESOPs and vested RSUs – based on your family’s requirements and cashflows.

Conclusion

Ultimately, the choice between the Regular and Direct route depends on your individual preferences, confidence, and involvement in managing your investments. Both approaches have their merits – while one offers cost savings, the other provides access to professional guidance and structured management.

Research Credits: Vishnu Mallipudi

Best Regards

Sri Subhash Yerneni,

Founder,

Vika Wealth.

- July 21, 2025

Family Office | Estate Planning | Tax Services | ESOP Advisory | Company Incorporations | Mutual Funds | PMS | Bonds | AIF | Offshore Investing | Private Equity and Venture Capital Funds

Disclaimer: All the above views are for educational purposes and are not given as investment advice.

Subscribe To Our Blogs

About Author

Sri Subhash Yerneni

Sri Subhash is an astute banking and finance professional with 14 years of real-world experience in wealth management, advisory of financial instruments such as mutual funds-equity and debt-alternate investment funds ( AIF)-structure and offshore products-private equity-venture capital/debt-bonds and MLDs-priority banking-cash management-team management-and working with various cultures in various nations.

Recent Blogs

Quick Links

Services

Services

Contact Info

3rd Floor, Plot No. 55/A, Rd No 52, BNR Hills, Jubilee Hills, Rai Durg, Hyderabad - 500081

Copyright © 2025 VIKA WEALTH – All Rights Reserved.

Quick Links

Services

Contact Info

3rd Floor, Plot No. 55/A, Rd No 52, BNR Hills, Jubilee Hills, Rai Durg, Hyderabad - 500081

Copyright © 2025 VIKA WEALTH – All Rights Reserved.