Understanding Step Up in an SIP

We have earlier mentioned how SIP is the 8th wonder of the world. The step-up feature is an important feature of an SIP that is available to investors.

What is this feature and how can investors use this to their advantage?

Introduction

By opting in for a step-up, the investor can automatically increase their SIP amount by a fixed percentage at regular intervals, typically on an annual basis.

For instance, let us take the case of a 5% annual step-up on an SIP of 1 lakh.

For every month in the first year, the investor will invest 1,00,000.

In year 2, the SIP amount will automatically increase to 1,05,000 each month.

In year 3, the SIP amount will be 1,10,250 each month and so on.

The Math

What impact does a step-up have on the power of compounding?

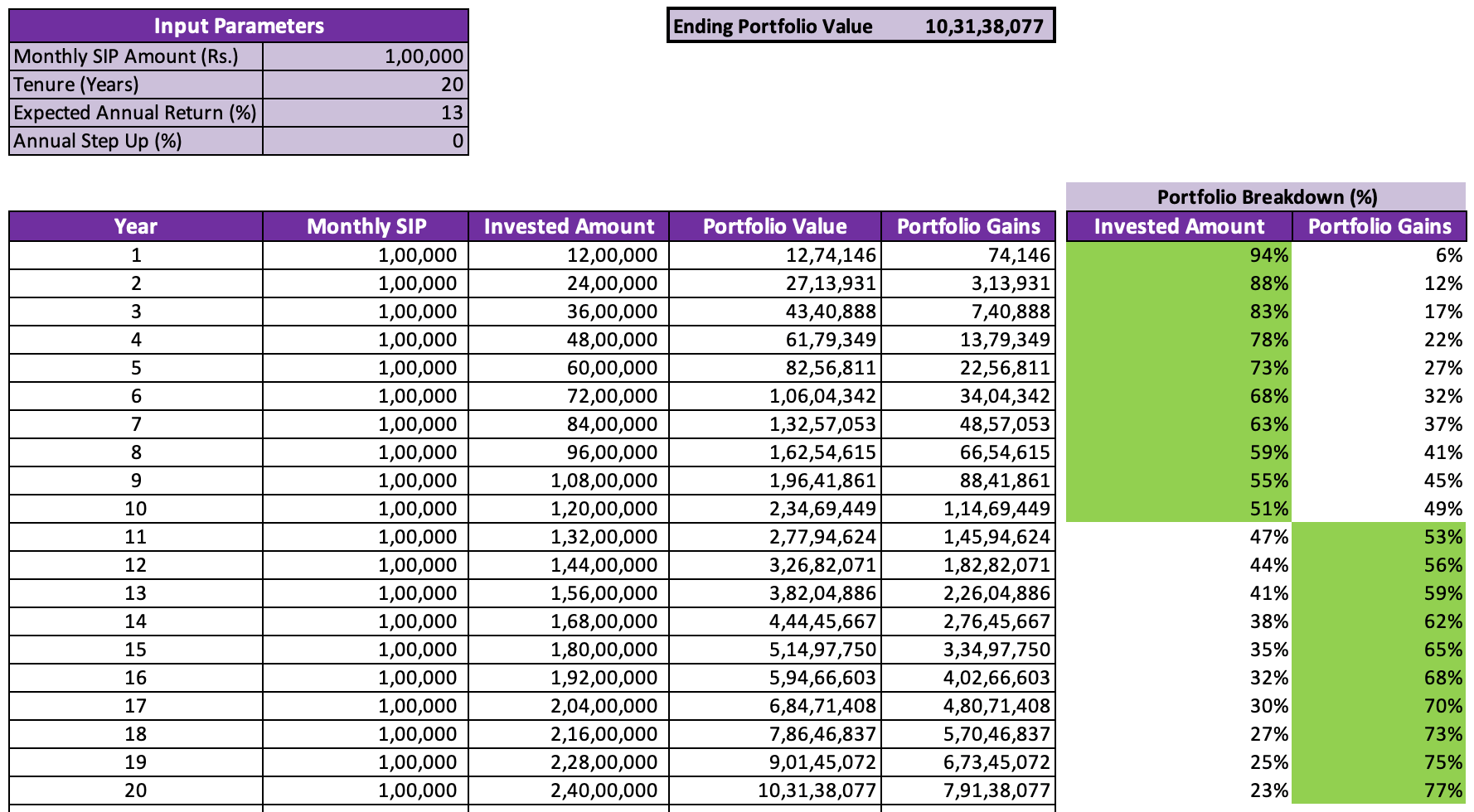

Let us start by looking at a 20-year SIP with zero step-up, assuming an expected annual return of 13%.

The portfolio breakdown columns show us the split between invested amount and portfolio gains in the final portfolio value at the end of each year.

As we see, the power of compounding starts to kick in after the 10th year, after which the portfolio gains constitute a greater portion of portfolio value than the invested amount.

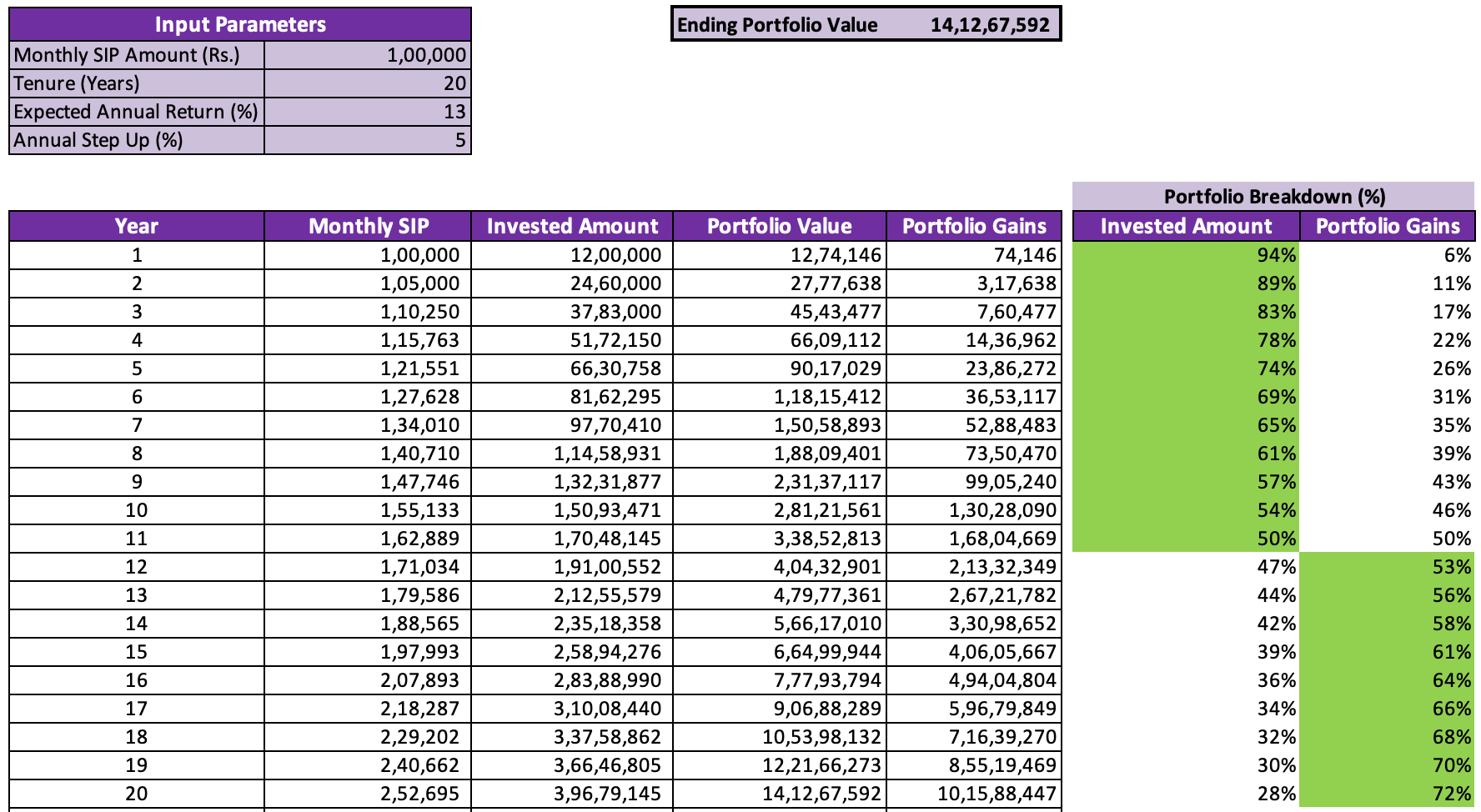

Now, we increase the annual step-up to 5% and see what impact it has on the portfolio breakdown.

We see that the portfolio gains start to outweigh invested amount from the 12th year onwards.

Why do we have to wait for longer in case of a step-up to see the benefits of compounding?

This is due to the fact that, by design, the step-up feature back-loads the cash inflows. By this, we mean that bigger cash inflows come in during later years in the SIP tenure. As a result, these inflows do not have as much time as the initial inflows to compound over multiple years.

Impact on XIRR

In continuation to the above point, a step-up results in a slightly lower XIRR for the investment, as compared to one without a step-up. XIRR is a time-weighted return metric, which gives more weightage to cashflows that come in earlier. Since the smaller cashflows come in earlier and have a higher weight, whereas the larger cashflows come in during later periods having lower weightage, we see reduced IRR.

Conclusion

A step-up feature will inevitably lead to a larger corpus than without it. One must note that the perks of the step-up feature come in terms of increasing your invested amount gradually, in line with an increase in income. This automatic nature of increasing investments maintains investment discipline and avoids wasteful expenditure. Just as with an SIP, even for the step-up feature, longer tenure is your best friend.

Research Credits: Vishnu Mallipudi

Best Regards

Sri Subhash Yerneni,

Founder,

Vika Wealth.

- August 13, 2025

Family Office | Estate Planning | Tax Services | ESOP Advisory | Company Incorporations | Mutual Funds | PMS | Bonds | AIF | Offshore Investing | Private Equity and Venture Capital Funds

Disclaimer: All the above views are for educational purposes and are not given as investment advice.

Subscribe To Our Blogs

About Author

Sri Subhash Yerneni

Sri Subhash is an astute banking and finance professional with 14 years of real-world experience in wealth management, advisory of financial instruments such as mutual funds-equity and debt-alternate investment funds ( AIF)-structure and offshore products-private equity-venture capital/debt-bonds and MLDs-priority banking-cash management-team management-and working with various cultures in various nations.

Recent Blogs

Quick Links

Services

Services

Contact Info

3rd Floor, Plot No. 55/A, Rd No 52, BNR Hills, Jubilee Hills, Rai Durg, Hyderabad - 500081

Copyright © 2025 VIKA WEALTH – All Rights Reserved.

Quick Links

Services

Contact Info

3rd Floor, Plot No. 55/A, Rd No 52, BNR Hills, Jubilee Hills, Rai Durg, Hyderabad - 500081

Copyright © 2025 VIKA WEALTH – All Rights Reserved.