India’s Industrial Moment - The Time is Now

India’s Industrial Moment: Learning from History, Building for the Future

Industrialization has been the launchpad for every modern economic superpower. From Britain’s steam engines to America’s automotive boom, the shift from agrarian or service-heavy economies to manufacturing-led growth has created millions of jobs, fuelled exports, and driven sustained GDP expansion. Today, India is entering that very phase — and doing so with the backing of a deliberate, well-funded industrial strategy.

The Shift Toward Manufacturing

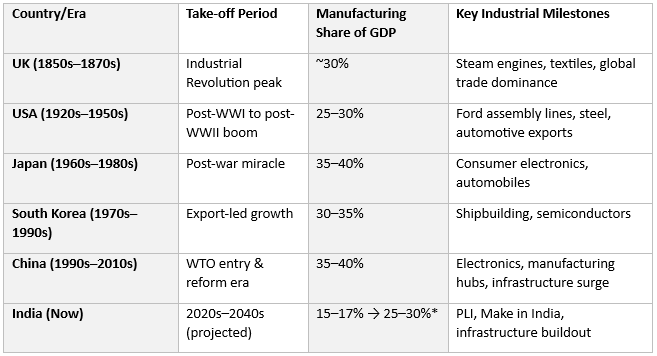

Unlike China, Japan, or South Korea — whose economic rise was powered by manufacturing contributing 30–40% of GDP — India’s first growth wave leaned heavily on services and consumption. Manufacturing’s share has hovered around 15–17% for decades.

That’s changing. With ₹111 lakh crore committed under the National Infrastructure Pipeline, industrial corridors coming online, and logistics efficiency improving (India now ranks 38th globally), the country is dismantling long-standing bottlenecks like costly transport, unreliable power, and fragmented supply chains.

The PLI Scheme: A New Playbook

The Production Linked Incentive (PLI) scheme, launched in 2020 with a ₹2 lakh crore outlay across 14 sectors, is India’s industrial catalyst. Unlike past subsidies, PLI is outcome-based — rewarding companies for actual production, investment, and job creation. Its impact is already visible:

- Electronics: Apple (via Foxconn) is assembling iPhones at scale in Tamil Nadu. India is now the world’s second-largest mobile phone manufacturer.

- Auto & EVs: Tesla and Toyota source components from Indian suppliers, while domestic players ramp up EV part manufacturing.

- Pharma: Backward integration is reducing API dependency on China.

- Defense: Exports are growing rapidly, with a $5B target by 2030.

- Renewables: India is building an end-to-end solar supply chain, enhancing energy security.

These shifts are embedding India into global supply chains — much as Japan did in the 1960s and China in the early 2000s.

Learning from the Giants

History shows that industrialization has consistently lifted nations into global leadership. The table below compares manufacturing’s share of GDP during the takeoff phase for past and present economic powers.

Why This Matters for India’s Future

Manufacturing brings job-rich growth, especially in semi-skilled segments. Each new industrial cluster triggers multiplier effects — boosting local consumption, improving trade balances, and deepening technology adoption. Lower logistics and energy costs improve return on invested capital (RoIC) for producers, while formal job creation strengthens household incomes.

Moreover, with global supply chains diversifying away from China, India is positioned as the “+1” manufacturing hub for the world. This is not just about low costs; it’s about scale, reliability, and policy certainty — areas where recent reforms have given India a decisive edge.

The Long Game

Britain’s industrial leadership took decades to translate into geopolitical dominance. The US overtook Britain economically in the early 20th century but only became the unchallenged global leader after WWII. China surpassed the US in PPP terms in 2014–15 but is still consolidating its influence.

For India, industrialization today is about laying the foundation for long-term leadership. Sustaining 8–10% annual GDP growth over decades, driven by manufacturing, infrastructure, and exports, could see India join the world’s top three economies by 2050.

History suggests that those who invest early in a nation’s industrial rise — as capital, technology, and talent converge — are best placed to reap generational rewards. India’s moment is now.

Best Regards

Sri Subhash Yerneni,

Founder,

Vika Wealth.

- August 18, 2025

Family Office | Estate Planning | Tax Services | ESOP Advisory | Company Incorporations | Mutual Funds | PMS | Bonds | AIF | Offshore Investing | Private Equity and Venture Capital Funds

Disclaimer: All the above views are for educational purposes and are not given as investment advice.

Subscribe To Our Blogs

About Author

Sri Subhash Yerneni

Sri Subhash is an astute banking and finance professional with 14 years of real-world experience in wealth management, advisory of financial instruments such as mutual funds-equity and debt-alternate investment funds ( AIF)-structure and offshore products-private equity-venture capital/debt-bonds and MLDs-priority banking-cash management-team management-and working with various cultures in various nations.

Recent Blogs

Quick Links

Services

Services

Contact Info

3rd Floor, Plot No. 55/A, Rd No 52, BNR Hills, Jubilee Hills, Rai Durg, Hyderabad - 500081

Copyright © 2025 VIKA WEALTH – All Rights Reserved.

Quick Links

Services

Contact Info

3rd Floor, Plot No. 55/A, Rd No 52, BNR Hills, Jubilee Hills, Rai Durg, Hyderabad - 500081

Copyright © 2025 VIKA WEALTH – All Rights Reserved.