Systematic Withdrawal Plan (SWP) - The 9th Wonder

Systematic Withdrawal Plan (SWP) is an important feature offered by mutual funds. Though not as popular as a Systematic Investment Plan (SIP), the SWP can be very helpful in planning cashflows, especially for retirees and those looking to establish a regular income stream.

What is a SWP?

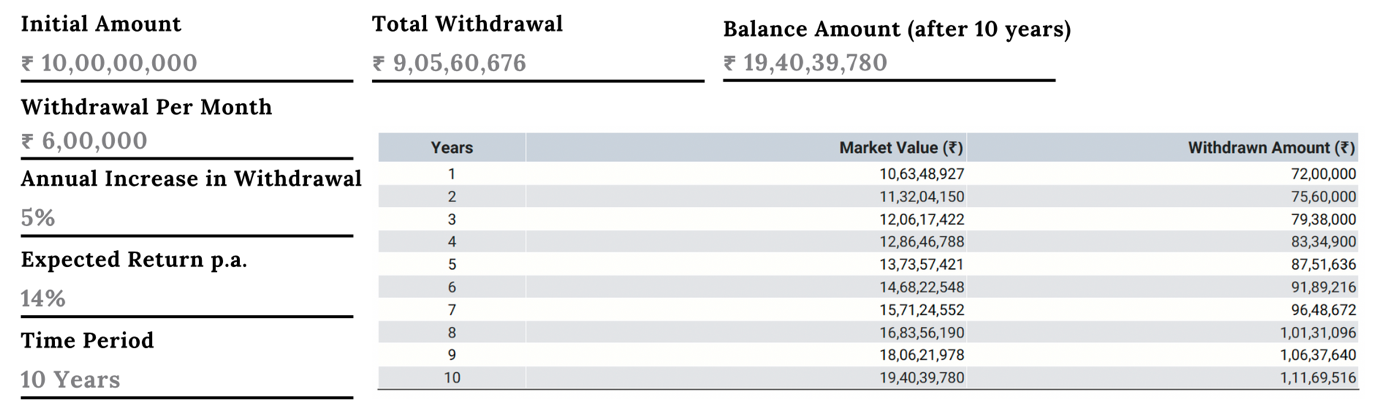

A SWP is a feature that allows mutual fund investors to withdraw a fixed amount from their investment at regular intervals (monthly, quarterly or annually). Instead of redeeming the entire investment at once, a SWP allows for creating a steady and predictable cashflow, while also allowing the remaining corpus to stay invested and reap the benefits of compounding.

The mutual fund house sells enough units at the applicable NAV, to generate the fixed cashflow each period. Alternatively, a SWP can also be set up as a percentage of the corpus, instead of a fixed withdrawal amount.

Main Benefits of a SWP

Regular Income: SWP provides a predictable cash flow periodically, suitable for those who need periodic expense coverage.

Capital Preservation and Growth: A major chunk of the corpus remains invested, allowing the investment to grow and compound.

Tax Efficiency: Taxes are payable only on gains realized with each withdrawal, not on the principal, helping reduce tax burden.

Flexibility: Investors can change withdrawal amounts and frequency to align with changing financial needs.

No Lock-in Period: Offers liquidity without waiting for a lock-in, allowing withdrawals to start anytime.

Key Considerations

Withdrawing Too Much Too Soon: Excessive withdrawals early on can quickly deplete the corpus.

Underestimating Inflation: Not adjusting withdrawal amounts for inflation results in reduced real income (lower spending power) over time.

Setting Withdrawal Limits: A conservative withdrawal limit is 4-5% annually of the total corpus. This will allow for the corpus to grow without being disturbed, thereby sustaining the withdrawals in the long-term.

Withdrawals should not exceed the returns generated by the fund; otherwise, the corpus will deplete faster.

The 10 year CAGR return for the Nifty 500 is around 15%. We can expect the fund to generate this return.

Tax Implications

Each SWP withdrawal requires redemption of mutual fund units. The withdrawal will typically consist of two parts, principal and capital gains, proportionate to the units redeemed.

Taxation on SWP is the same as on regular mutual fund investments. Capital gains are taxed on the basis of investments and holding period.

- Equity Mutual Funds

Held for longer than 12 months (LTCG):

Gains are tax-free up to 1.25 lakhs per year.

Gains over 1.25 lakhs are taxed at 12.5%.

Held for less than 12 months (STCG):

Gains are taxed at 20%.

- Debt Mutual Funds

Investments made before April 1, 2023:

LTCG (units held for over 2 years): Taxed at 12.5%, no indexation benefit.

STCG: Taxed as per income tax slab.

Investments made after April 1, 2023:

LTCG and STCG: Taxed as per income tax slab.

- Hybrid Mutual Funds

If equity component ≥65%, taxed as equity fund.

If equity <65%, taxed as debt fund.

As SWP spreads across the redemptions over multiple years, rather than having a lumpsum redemption, it reduces the incidental tax burden and possibly even avoids it if LTCG are below the annual threshold of 1.25 lakhs.

SIP + SWP: A powerful combination

Though it may sound counterintuitive, you can do a SIP and a SWP simultaneously.

- SIP helps you accumulate wealth over time by investing fixed amounts regularly, benefiting from rupee cost averaging and compounding.

- SWP helps you withdraw a fixed amount regularly from your corpus, providing a steady income stream without fully liquidating your investments.

Benefits of using a SIP and SWP together

Continuous Wealth Creation and Income Generation: SIP keeps growing your investment corpus by disciplined investing while SWP provides you with regular income from your existing investments.

Market Volatility Benefits: SIP allows you to buy more units when the market is down (rupee cost averaging), and SWP provides scheduled withdrawals, reducing the need for panic selling.

Flexibility: You can pause or adjust SIP amounts based on your financial situation while continuing withdrawals through SWP. This flexibility allows for continued financial discipline and prevents panic.

Financial Discipline: SIP instils disciplined saving, and SWP ensures disciplined planning and usage of your investment corpus for expenses.

Conclusion

Opting for a SWP offers a disciplined and reliable way to generate regular income while keeping the remaining investment intact. It not only provides financial stability through steady withdrawals but also enhances tax efficiency. This makes SWP a practical and beneficial feature in mutual fund investing.

Research Credits: Vishnu Mallipudi

Best Regards

Sri Subhash Yerneni,

Founder,

Vika Wealth.

- September 4, 2025

Family Office | Estate Planning | Tax Services | ESOP Advisory | Company Incorporations | Mutual Funds | PMS | Bonds | AIF | Offshore Investing | Private Equity and Venture Capital Funds

Disclaimer: All the above views are for educational purposes and are not given as investment advice.

Subscribe To Our Blogs

About Author

Sri Subhash Yerneni

Sri Subhash is an astute banking and finance professional with 14 years of real-world experience in wealth management, advisory of financial instruments such as mutual funds-equity and debt-alternate investment funds ( AIF)-structure and offshore products-private equity-venture capital/debt-bonds and MLDs-priority banking-cash management-team management-and working with various cultures in various nations.

Recent Blogs

Quick Links

Services

Services

Contact Info

3rd Floor, Plot No. 55/A, Rd No 52, BNR Hills, Jubilee Hills, Rai Durg, Hyderabad - 500081

Copyright © 2025 VIKA WEALTH – All Rights Reserved.

Quick Links

Services

Contact Info

3rd Floor, Plot No. 55/A, Rd No 52, BNR Hills, Jubilee Hills, Rai Durg, Hyderabad - 500081

Copyright © 2025 VIKA WEALTH – All Rights Reserved.