Applying Stoic Investing in Our Recent Decisions

At VIKA Wealth, we believe that successful investing isn’t about predicting markets – it is about mastering temperament, discipline, process and decision-making. Our recent actions across different asset classes reflect this mindset. Each investment decision is guided by the timeless principles of Stoic Investing, where philosophy meets portfolio management. If you haven’t already, refer to our previous article on Stoic Investing before reading this.

1. Silver: Staying Grounded in a Greedy Market

(Key Topics: Avoid the Herd | Stay Emotionally Balanced)

In recent months, we have seen growing enthusiasm around silver – a classic case of herd behaviour, with many investors chasing short-term returns after a sharp rally. Recognizing this euphoria, we consciously avoided fresh buying. As Stoics remind us, independence of thought matters more than popularity. When too many are drawn to a trade out of greed or FOMO, that is often the time to pause. After the recent correction, we are methodically re-evaluating entry opportunities, ensuring decisions stem from conviction, not emotion.

2. Unlisted Stocks: Focusing on Fundamentals

(Key Topics: Build a Margin of Safety | Focus on the Process, Not the Outcome)

Our approach to unlisted equities is rooted in prudence and discipline. We never invest for the sake of participation. Instead, we ensure a margin of safety through conservative valuation buffers, a close study of fundamentals, and a focus on liquidity. Each investment undergoes strict portfolio weighting to manage risk. This aligns perfectly with the Stoic lesson of focusing on controllable actions – sound research, process, discipline, and prudent valuation – rather than chasing hype and uncertain outcomes.

3. Asset Allocation: The Framework That Endures

(Key Topics: Focus on the Process, Not the Outcome | Keep Perspective)

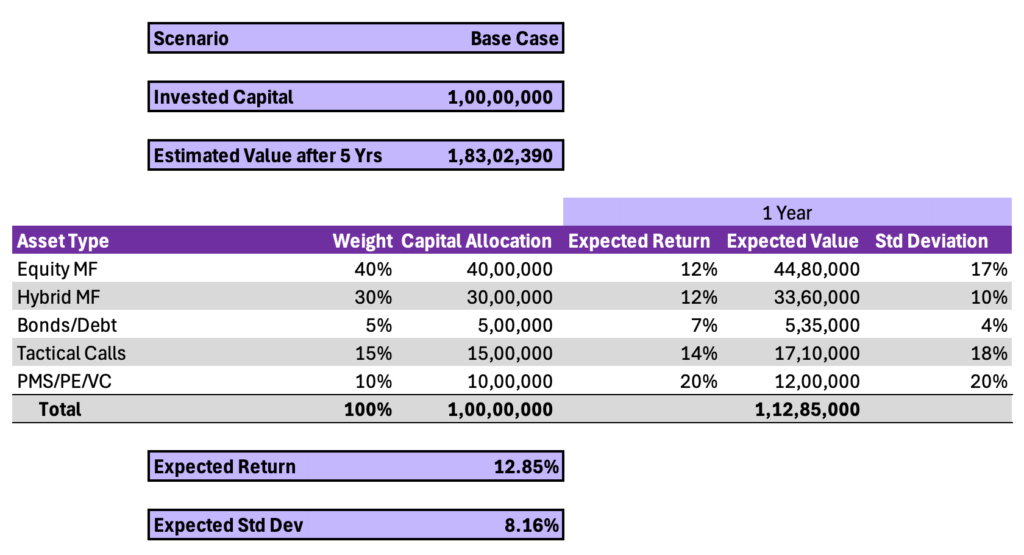

Asset allocation forms the foundation of every client portfolio. Through our in-house allocation framework, we consider multiple dimensions: risk-return trade-offs, correlations, fund manager styles, and time horizons. This process-driven approach ensures that portfolios remain balanced across cycles. By staying grounded in our method, rather than reacting to short-term performance, we follow the Stoic virtue of perspective – recognizing that long-term progress matters more than temporary fluctuations. Below is a sample of our asset allocation framework.

4. Emotional Balance: Practicing Reflection and Rationality

(Key Topics: Stay Emotionally Balanced | Reflect Regularly)

Emotional balance is vital in volatile markets. We achieve this through structured analysis – reviewing over 30 domestic and global macro indicators every month. This disciplined review not only helps us make informed strategic allocations and tactical calls, but also provides a platform for reflection. Much like Marcus Aurelius’s practice of self-examination, we routinely assess whether our actions are driven by logic or emotion. This ongoing reflection sharpens our judgment and reinforces our process.

5. Accepting the Uncontrollable: Preparation Over Prediction

(Key Topics: Accept the Uncontrollable | Patience Is Strength)

Markets are shaped by countless external forces – wars, tariffs, oil shocks, currency shifts – all beyond our control. Rather than attempting to predict them, we focus on preparation. Our strategy of deploying capital in phases, particularly over the last year, reflects this Stoic principle. By exercising patience and adhering to a disciplined framework, we safeguard client capital and ensure steady progress even in uncertain conditions.

Conclusion

Each of these decisions reflects our belief that Stoicism and Investing must go hand-in-hand. Both reward patience, discipline, and perspective. While markets will always fluctuate, our goal remains constant: to act with rationality, stay emotionally balanced, and focus on the process. In doing so, we not only manage money better – we cultivate better investor behaviour and experience.

Best Regards

Sri Subhash Yerneni,

Founder,

Vika Wealth.

- October 24, 2025

Family Office | Estate Planning | Tax Services | ESOP Advisory | Company Incorporations | Mutual Funds | PMS | Bonds | AIF | Offshore Investing | Private Equity and Venture Capital Funds

Disclaimer: All the above views are for educational purposes and are not given as investment advice.

Subscribe To Our Blogs

About Author

Sri Subhash Yerneni

Sri Subhash is an astute banking and finance professional with 14 years of real-world experience in wealth management, advisory of financial instruments such as mutual funds-equity and debt-alternate investment funds ( AIF)-structure and offshore products-private equity-venture capital/debt-bonds and MLDs-priority banking-cash management-team management-and working with various cultures in various nations.

Recent Blogs

Quick Links

Services

Services

Contact Info

3rd Floor, Plot No. 55/A, Rd No 52, BNR Hills, Jubilee Hills, Rai Durg, Hyderabad - 500081

Copyright © 2025 VIKA WEALTH – All Rights Reserved.

Quick Links

Services

Contact Info

3rd Floor, Plot No. 55/A, Rd No 52, BNR Hills, Jubilee Hills, Rai Durg, Hyderabad - 500081

Copyright © 2025 VIKA WEALTH – All Rights Reserved.