2026 Yearly Outlook

Market Recap: 2025 in Review

The year 2025 was nothing short of a roller coaster. Despite multiple global challenges, geopolitical conflicts, trade tariffs, weaker-than-expected domestic earnings, and the FII capital outflows that began in late 2024 continued through the first half of 2025, resulting in muted to negative market performance. Further uncertainty was added in the form of tariffs, the effects of which persist to date.

Despite all this, Indian equity markets ended the year on a positive note, with the exception of the small-cap index. This reflection frames our understanding and the broad outlook for 2026.

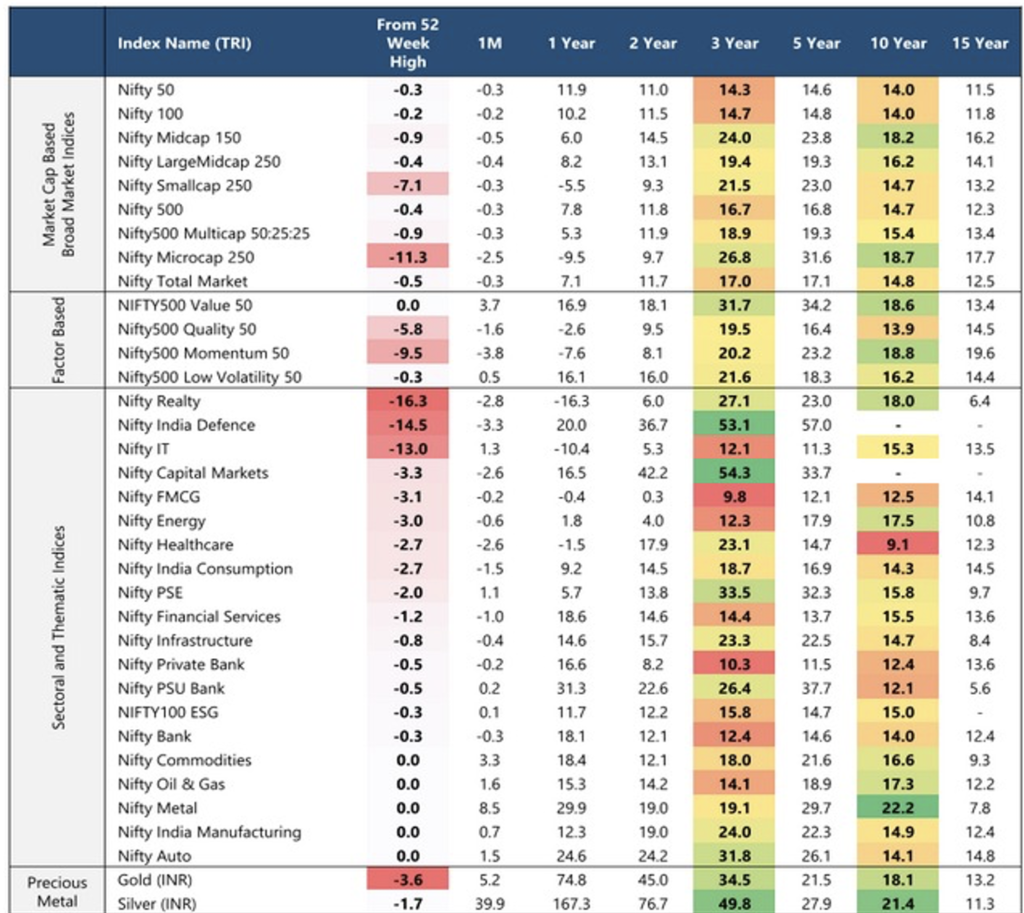

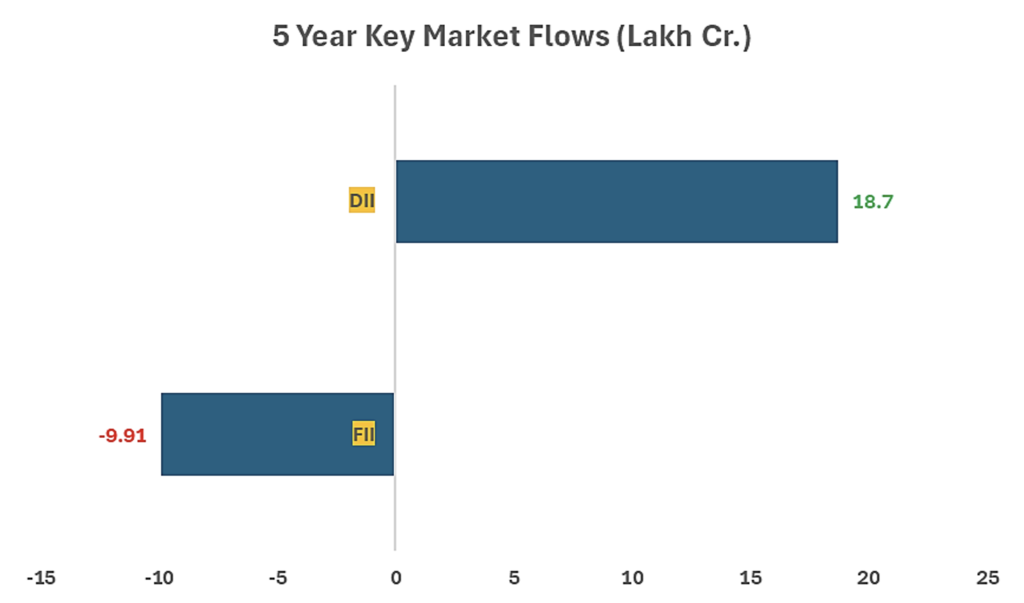

Market Performance

Source: MOSL and WOC AMC

Source:Internal

Interpretation

2025 began as a year of uncertainty, marked by a bearish equity market outlook and the looming fears of a new American presidency. The FII capital outflows that began in late 2024 continued through the first half of 2025, resulting in muted to negative market performance. The government has been put in a unique situation, with increasing consumption coupled with the danger of a deflating economy. Domestic participation has emerged as a key stabilising force.

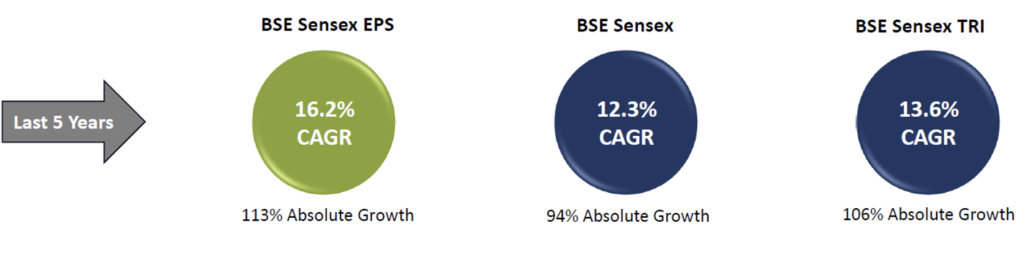

Earnings & Markets Correlation

Source: MOSL and WOC AMC

The data clearly reinforces a fundamental truth: over the long term, equity market returns are driven by earnings growth. Markets may deviate in the short term, but earnings ultimately anchor valuations and returns. 2025 can be understood as an example of the same.

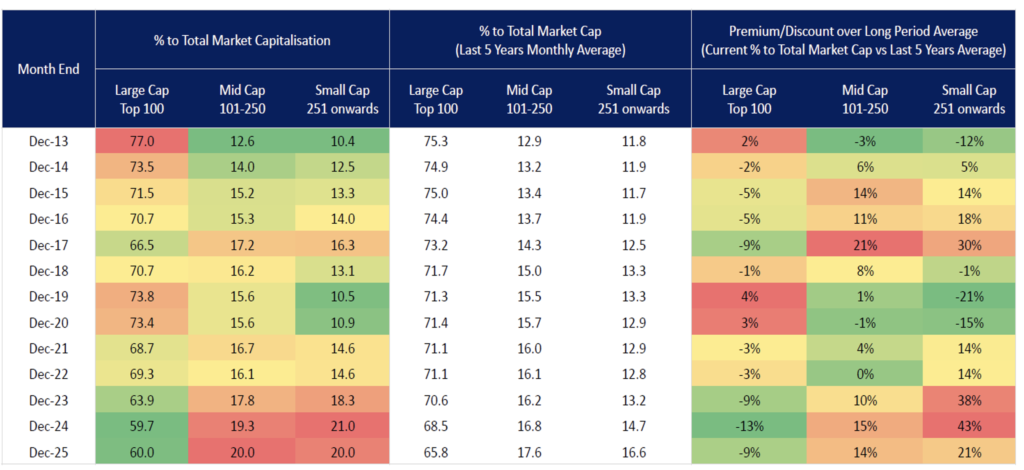

Market Cap Contribution

Source: MOSL and WOC AMC

The share of large-cap contribution has declined and is now more evenly distributed across mid and small caps. This shift is also reflected in relative performance, with SMID segments outperforming large caps in recent years.

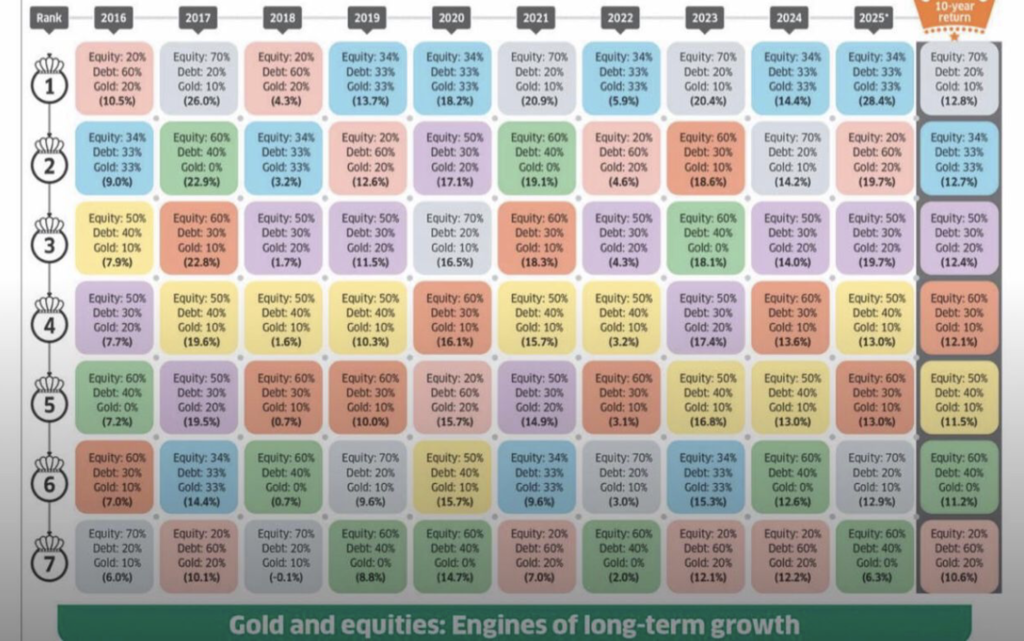

Diversification: The True Compounder

Source: ET

The above chart underscores the importance of asset allocation in achieving diversification, lowering portfolio volatility, and improving risk-adjusted returns by reducing correlations across asset classes. Even in periods of high uncertainty, such as 2025, efficient asset allocation can drive returns.

What went right for us in 2025:

- Silver

- Banking and Financial Services

- China

- Large Cap

- Low Volatility

- Not investing lumpsums in Small Cap

- Manufacturing

What went wrong for us:

- US markets

- Long and medium Duration

- Quality

- Value

- Healthcare

- FMCG

This reflection frames our understanding and the broad outlook for 2026.

Market Outlook for 2026

India: Constructive, Earnings-Led Optimism

Overall stance: Cautiously optimistic with a domestic growth bias

Valuations & Reflections

Markets typically move higher due to one or more of the following factors:

- Strong earnings growth

- Attractive valuations

- Supportive liquidity and fund flows

For sustained market performance, valuation comfort is essential, and this is visible in select pockets of the market.

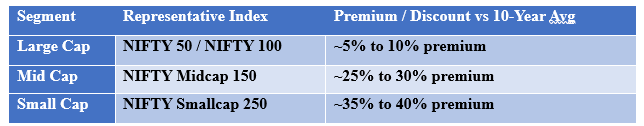

Current vs Historical Valuations

Source: Reuters & Screener

Source: Reuters & Screener

However, valuations alone should not be the sole determinant of investment decisions. Liquidity conditions, fund flows, and macroeconomic indicators also play a critical role. While valuations in mid and small caps are elevated, selective exposure cannot be entirely ruled out and must be aligned with individual investor objectives and risk profiles. Understanding this, we assess the macroeconomic conditions to understand the themes that would play out.

Key Themes

- Earnings recovery to be the single biggest driver for 2026

After a weak 2025, earnings momentum has already started improving (Q2FY26 showed double-digit PAT growth). Most managers expect H2FY26 and FY27 to be stronger on:- Margin recovery

- Rate-cut transmission

- Consumption revival (urban + rural)

- Public capex and manufacturing push

- Macro remains resilient despite global stress

- India GDP growth remains among the highest globally

- Inflation is easing; RBI is in a supportive stance

- “Goldilocks” phase: reasonable growth + manageable inflation

- Domestic flows are the structural stabiliser

- DIIs and SIP flows continue to offset persistent FII selling

- Financialisaton of household savings is now a long-term trend, not cyclical

- Markets are no longer fully dependent on foreign capital

- Valuations: reasonable in large caps, stretched in SMIDs

- Large caps near long-term averages → better risk-reward

- Mid & small caps need earnings delivery to justify valuations

Preferred themes/sectors for 2026

- Private banks, wealth tech & financial services

- Solar, renewable energy, manufacturing (Led by Make-in-India and PLI initiatives)

- Consumption (Primarily led by rural consumption)

- Select auto & auto ancillaries

- Hospitals / healthcare

- Large caps

- Mid and Small cap (Only opportunity and investor objective based)

- Themes: Quality and Low Volatile

Tactical Calls

Europe, IT, Copper, China, Japan and Brazil (To be considered for high-risk investors) and Emerging Markets

The dynamic nature of the markets presents opportunities at different times during the year. Our continuous research helps us identify these trends and opportunities.

India risk factors to watch

- Earnings disappointment

- Geopolitical issues

- Extended FII selling if global rates stay higher for longer

Bottom line for India:

2026 is expected to be more earnings-driven rather than liquidity-driven, with moderate but healthier returns and more sustainable returns for long-term investors.

At Vika Wealth, asset allocation remains the cornerstone of our investment philosophy. Every investor is unique. By tracking multiple metrics, funds, and macro indicators, and by deeply understanding investor objectives, goals, and risk appetite, we aim to construct robust, goal-aligned portfolios. Staying true to our philosophy of Managing Risk vs Return, we invest significant time in understanding each investor’s needs to create portfolios aligned with their financial journey.

Best Regards

Sri Subhash Yerneni,

Founder,

Vika Wealth.

- January 16, 2026

Family Office | Estate Planning | Tax Services | ESOP Advisory | Company Incorporations | Mutual Funds | PMS | Bonds | AIF | Offshore Investing | Private Equity and Venture Capital Funds

Disclaimer: All the above views are for educational purposes and are not given as investment advice.

Subscribe To Our Blogs

About Author

Sri Subhash Yerneni

Sri Subhash is an astute banking and finance professional with 14 years of real-world experience in wealth management, advisory of financial instruments such as mutual funds-equity and debt-alternate investment funds ( AIF)-structure and offshore products-private equity-venture capital/debt-bonds and MLDs-priority banking-cash management-team management-and working with various cultures in various nations.

Recent Blogs

Quick Links

Services

Services

Contact Info

3rd Floor, Plot No. 55/A, Rd No 52, BNR Hills, Jubilee Hills, Rai Durg, Hyderabad - 500081

Copyright © 2025 VIKA WEALTH – All Rights Reserved.

Quick Links

Services

Contact Info

3rd Floor, Plot No. 55/A, Rd No 52, BNR Hills, Jubilee Hills, Rai Durg, Hyderabad - 500081

Copyright © 2025 VIKA WEALTH – All Rights Reserved.