How Prediction Distracts Investors

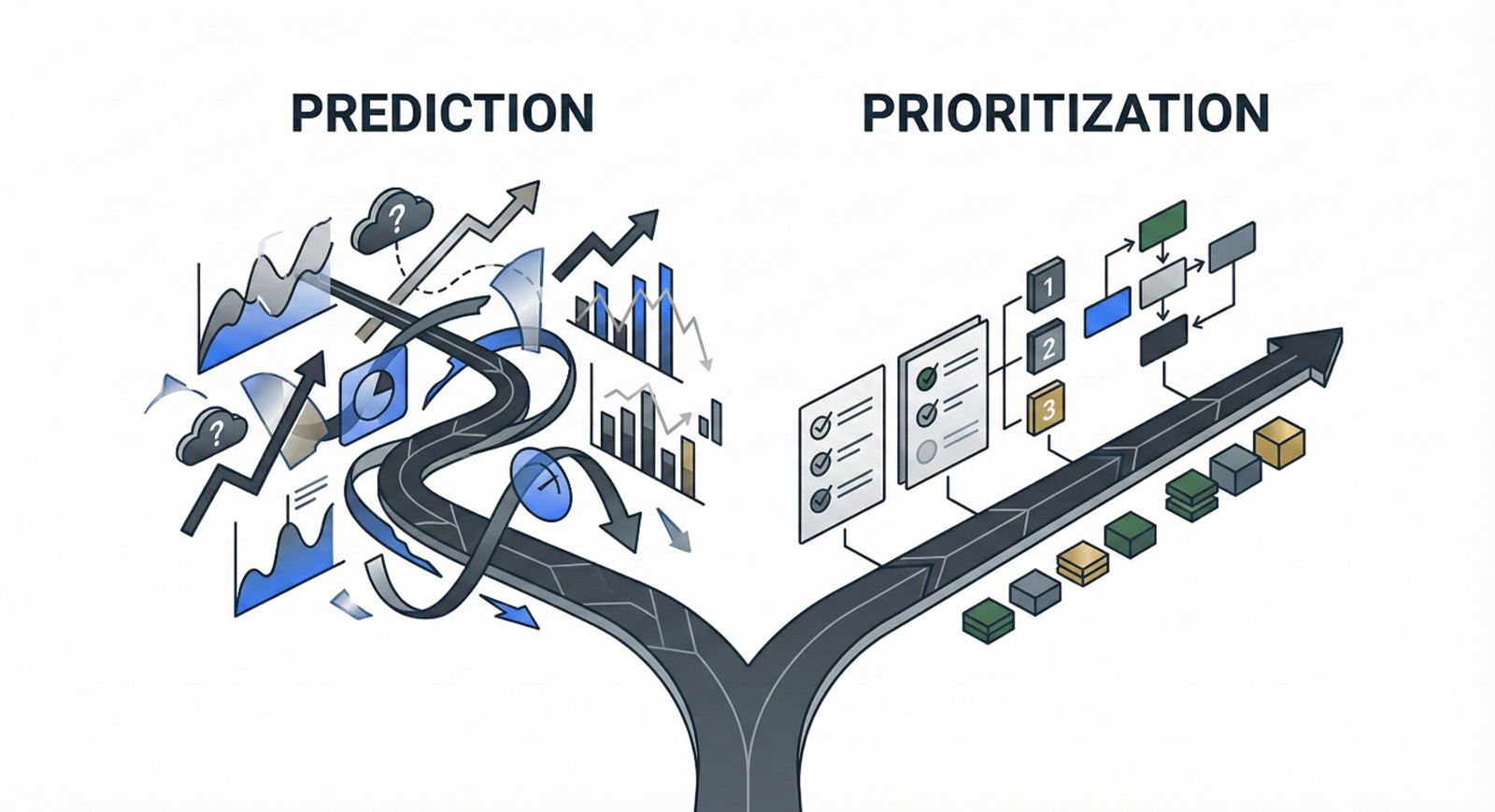

It is assumed by many that financial advice is all about forecasts; where markets may go, which sectors may lead, and how interest rates changes or geopolitics might play out. Clients often assume that advisory value lies in making these calls. But in practice, the advisors who protect and compound wealth are not the ones who predict, but the ones who prioritize.

Prediction tries to be right about the future. Prioritization makes sure the client survives the present and stays invested long enough to benefit from the future. That distinction is the biggest wealth compounder.

The Flaw in Prediction

Most retail investors do not fail because they misread macro conditions. They fail because of how they naturally sequence decisions. When new information appears – a report, a recommendation, or a theme – the instinctive process tends to be:

- Develop early conviction

- Estimate return potential

- Deploy capital

From a client’s perspective, this feels logical and disciplined.

When volatility hits, portfolios see negative returns not because the idea failed, but because the decision architecture around it was incomplete. The cracks in the structure are not obvious until stress arrives.

Emergency buffers, sizing discipline, personal time horizons, and exit rules are important considerations when a decision is to be made. Without these, even sound ideas are fragile.

Clients Don’t Lack Information; They Lack a Decision Framework

Clients today have abundant access to financial information, reports, earnings calls, market commentary, newsletters, and peer opinions. As the adage goes, the assumption becomes “Information is power”.

But in markets, understanding without structuring produces confidence without preparedness. This creates premature conviction, the sense that one is ready to act before the decision has been fully built out.

Markets are not rewarded on opinions; they are rewarded on prioritization + behaviour + sequencing.

Wealth is often lost not through ignorance, but through decisions that are not calibrated for individual goals.

Why Prioritization Matters

Prioritization forces the right questions to come first:

- Do we have the liquidity for this?

- What happens if this goes against us?

- What else are we sacrificing by doing this now?

These are simple questions, but they prevent expensive mistakes. Research doesn’t ask them because research talks about assets. Prioritization talks about clients.

Risk Profiling & Strategy Adherence

Sound strategies are constructed keeping the risk appetite of the investor in mind. Risk profiling exists to align the strategy with the investor, rather than the other way around. It is important to understand that a strategy only works if you stay with it long enough for it to play out. Most strategies fail not because they were flawed, but because they were interrupted.

The Need for Emotional Discipline

Markets test temperament more often than they test knowledge. We, at Vika Wealth, keep underscoring the importance of emotional discipline, as most wealth destruction doesn’t come from crises or frauds. It stems from poorly timed decisions made in the wrong order: premature conviction, concentrating before diversifying, and exiting positions due to false alarms.

Longevity, the key compounding factor, stems from behavioral discipline, not forecasting accuracy.

Attention: The Scarce Resource

Products, forecasts and reports are abundant. Client attention is scarce. Advisors who prioritize help clients focus on the few decisions that matter and ignore the many that don’t.

When that focus is achieved, portfolios become calmer, decisions become cleaner, and wealth becomes more durable.

Conclusion

Markets do not reward clairvoyance. They reward longevity. And longevity is driven by behavior, sequencing, and clarity, not prediction.

The best advisors do not claim to see the future. They build portfolios that can survive it.

Research Credits: Pranay Tippavajhala

Best Regards

Sri Subhash Yerneni,

Founder,

Vika Wealth.

- January 27, 2026

Family Office | Estate Planning | Tax Services | ESOP Advisory | Company Incorporations | Mutual Funds | PMS | Bonds | AIF | Offshore Investing | Private Equity and Venture Capital Funds

Disclaimer: All the above views are for educational purposes and are not given as investment advice.

Subscribe To Our Blogs

About Author

Sri Subhash Yerneni

Sri Subhash is an astute banking and finance professional with 14 years of real-world experience in wealth management, advisory of financial instruments such as mutual funds-equity and debt-alternate investment funds ( AIF)-structure and offshore products-private equity-venture capital/debt-bonds and MLDs-priority banking-cash management-team management-and working with various cultures in various nations.

Recent Blogs

Quick Links

Services

Services

Contact Info

3rd Floor, Plot No. 55/A, Rd No 52, BNR Hills, Jubilee Hills, Rai Durg, Hyderabad - 500081

Copyright © 2025 VIKA WEALTH – All Rights Reserved.

Quick Links

Services

Contact Info

3rd Floor, Plot No. 55/A, Rd No 52, BNR Hills, Jubilee Hills, Rai Durg, Hyderabad - 500081

Copyright © 2025 VIKA WEALTH – All Rights Reserved.