Why this decade belongs to India?

Past returns do not guarantee future returns. Hence it is important to look at what lies ahead for India as a country.

I am a very firm believer that this decade belongs to India.

Let’s look at Below some of the reasons why I feel so.

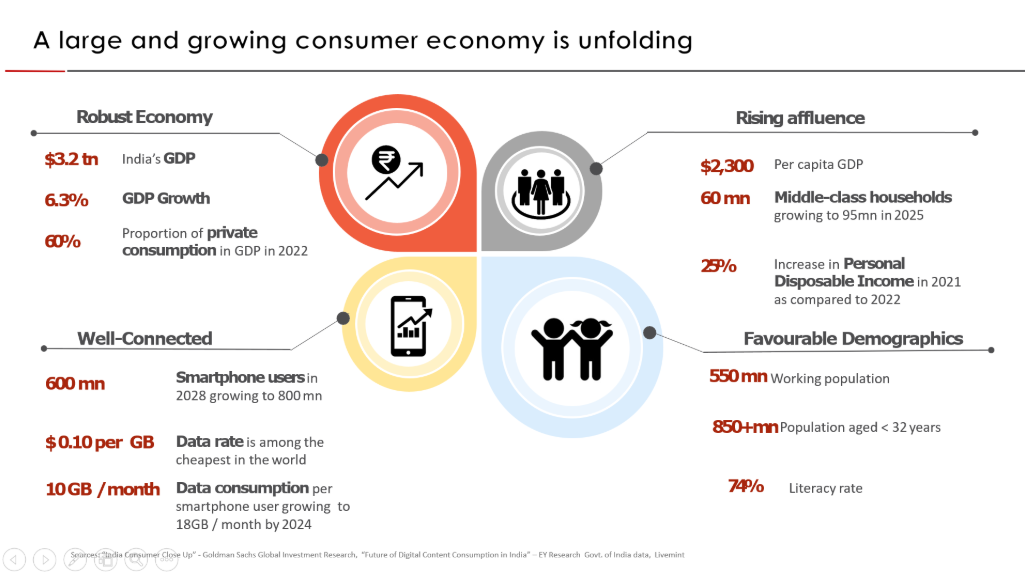

If you look at some of the parameters mentioned above. A lot has changed in the country in the last decade, we have become more tech-savvy. Internet consumption, the working population, has gone up, and the average age has come down.

This has made the Indian market more resilient than ever. FII has sold Indian Equities worth close to 4 Lakh Crores in the last 3 years and Domestic institutions like LIC, Mutual Funds, and Retail Investors have invested close to the same amount as FII’s outflows.

There are a lot of people who could argue there are so many job losses now. One of the reasons that happened because most of the companies in the developed economies were getting literally loans/credit at 0% interest rates and a few large listed Indian Companies were borrowing at super low rates through the ECB route.

With such low-interest rates, large investors wanted high-risk-adjusted returns. That is where your private equity and venture capital players started pouring money into start-ups. This is where greed kicks in and companies tend to overspend on multiple things. When the tide turns, you will see what is happening now i.e. job layoffs, sorry to use this-pink slips coming employee’s way, SVB crisis, etc.

Now, I keep hearing with only job loss data, people tend to frame it as a Recession. My firm belief is, you need to look at other macro data points to come to any conclusion.

Let’s look at some reasons why Indian markets have been resilient:

Covid has propelled the number of Demat accounts which opened in the last 2.5 years. From 3.6 CR in the fiscal year-end 2020, Sensex came into existence in the year 1986, it took 34 years to reach 3.6 CR accounts to approximately 11 CR today. That is a 200% increase.

The 3.6 CR Demat account holders who entered before April 2020 have a collective portfolio value of 305 lakh crore (the average per Demat account comes to Rs 84 lakh). The 7 CR people who came after 2020, well collectively own 65 lakh crore worth (the average comes to approximately 9 lakhs).

The above points reiterate why India has been resilient in the last 3 years.

Before the pandemic, the dependency on FII was high. We are starting to see that to come down because of the above reasons.

CY 13-22, FII’s equity contributions in the Indian market is $69.8 Billion, in CY 18-22, the contribution falls to $ 19.7 billion, i.e. 3.3 times fall.

Cy 13-22 DII’s equity contributions in the Indian market are $ 77.1 Billion, in CY 18-22, the contribution is $ 65.3 billion, and the flows are very much in line.

Not only that SIP Inflows every month into markets has been icing on the cake. This is where the demographics in the coming years, increase in the Tech use age, and awareness will help the markets to reach newer heights.

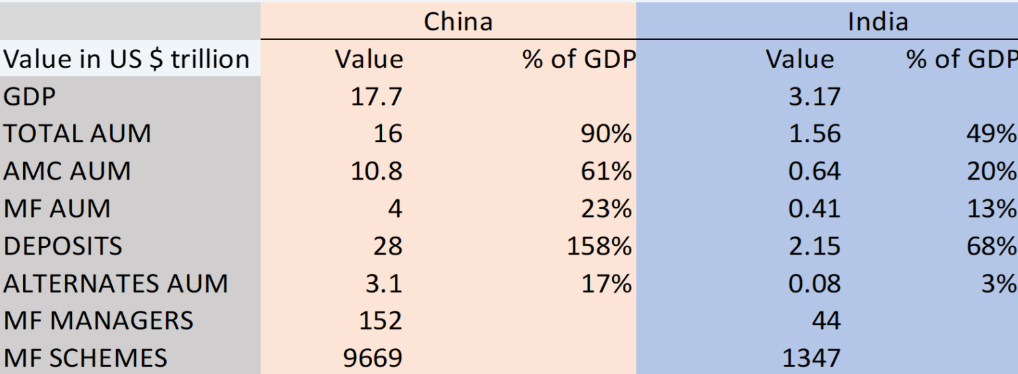

The notable opportunity we see happening in India is incremental AUM growth happening in the MF AUM.

In 2015, the MF AUM was 10 trillion (INR), now the number is about 4.1 trillion. Increase of 4 times in 7 years. In the last 4 years from 20 trillion, it has become 4.1 trillion. MF AUM has doubled in 4 years.

The total MF folios in India 2 years was about 9 CR and today we are about 14.2 CR. 60% increase in 2 years.

The penetration, ease of transaction, and understanding of the markets through different mediums has gone up and risk-taking ability in the coming years would be skewed toward financial markets.

Shall continue the discussion in the second part in the coming days.

Until then see ya!

- Apr 12, 2023

Subscribe To Our Blogs

About Author

Sri Subhash Yerneni

Sri Subhash is an astute banking and finance professional with 14 years of real-world experience in wealth management, advisory of financial instruments such as mutual funds-equity and debt-alternate investment funds ( AIF)-structure and offshore products-private equity-venture capital/debt-bonds and MLDs-priority banking-cash management-team management-and working with various cultures in various nations.

Recent Blogs

Quick Links

Services

Services

Contact Info

Plot No. 104, Usha's The Felicity, Fourth Floor, Road No. 2, Kakatiya Hills, Jubilee Hills, Hyderabad, Telangana 500033

Copyright © 2025 VIKA WEALTH – All Rights Reserved.

Quick Links

Services

Contact Info

Plot No. 104, Usha's The Felicity, Fourth Floor, Road No. 2, Kakatiya Hills, Jubilee Hills, Hyderabad, Telangana 500033

Copyright © 2025 VIKA WEALTH – All Rights Reserved.