Parameters To Look At While Investing In Mid Caps Funds?

In the previous blog, we discussed how many midcaps funds have beaten the benchmark.

To continue where we left off, in this blog let us cover what are the parameters to look at while investing in midcap funds.

Point To Point Return:

“Point-to-point return” in the context of mutual funds often refers to the investment performance or return of a mutual fund over a given period, measured from one specified point in time to the next. It offers a tool to evaluate the growth or loss of the fund’s investments throughout that period.

To calculate the point-to-point return of a mutual fund, the ending value is divided by the initial value, and the result is expressed as a percentage or a decimal. The formula can be represented as:

Point-to-Point Return = Initial Value – (Ending Value)

For instance, the point-to-point return for a mutual fund with a starting value of 100 at the start of the year and an ending value of 120 at the end of the year would be:

Return from Point to Point = (120 / 100) – 1 = 0.2 or 20%

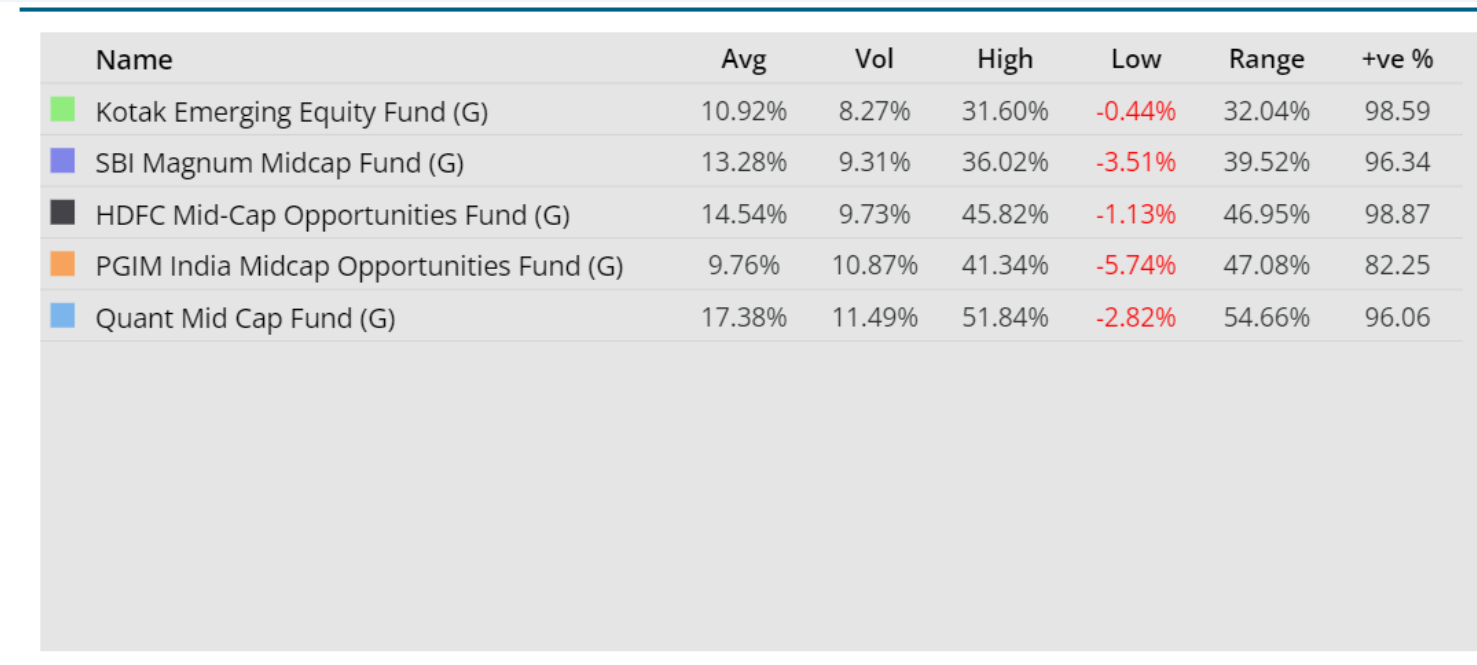

Rolling Return:

When referring to mutual funds, the term “rolling return” describes how investment performance is calculated across several consecutive periods. It gives investors a tool to evaluate the fund’s performance over various holding times and enables them to comprehend how the fund has performed over various time horizons for investing.

Investors can evaluate how a mutual fund has performed under various market circumstances and time frames by looking at rolling returns. Compared to a single point-to-point return, it offers a more complete picture of a fund’s performance. Investors can assess a fund’s volatility and the range of returns it has produced over time by using rolling returns.

Rolling returns are historical computations and may not ensure future performance, as should be noted. When making investing decisions, investors should consider several additional aspects in addition to rolling returns, such as fund objectives, risk profile, fee ratio, and investment approach.

Example: If we have to calculate the rolling return of the fund, let us take April 1st, 2022 to March 31st, 2023. In the point-to-point return, it takes the starting mentioned date to the final date. What happens in between is not captured.

In the rolling return, everyday returns from the beginning to the end are considered, which gives a more holistic view of the fund’s performance.

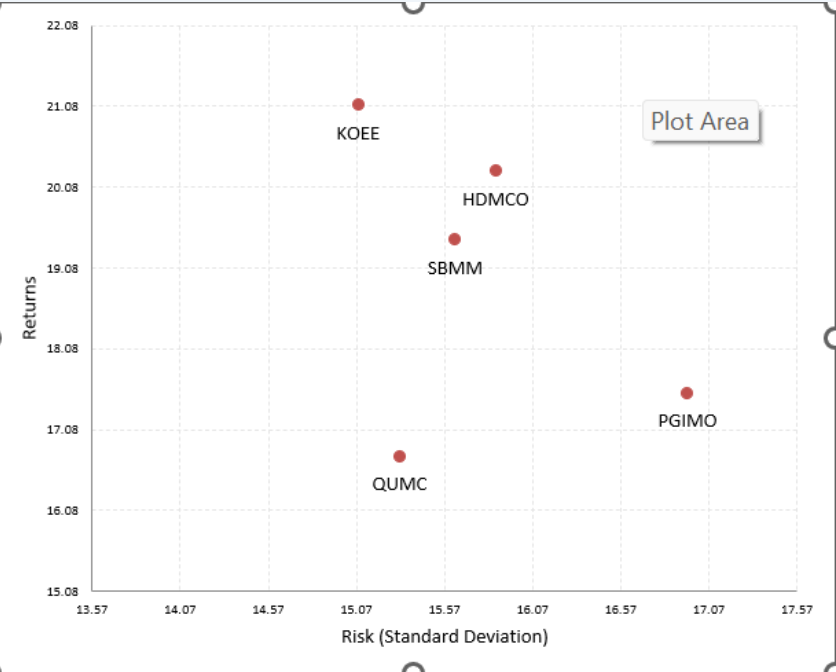

RISK vs Return:

We at Vika Wealth, as our tagline says give lots of importance to Risk & Return. We just do not by point-to-point return but take into consideration Rolling return, what is the risk taken for the return generated, Fund manager experience, Fund Management Style, Upside-Downside Capture, Information Ratio, Sharpe Ratio, etc.

Portfolio Overlap:

Portfolio overlap is crucial while investing. While evaluating portfolios I came across many investors having 3-4 funds in the same category. It does not make any sense to have too many funds because, the same stocks are getting overlapped in the funds, especially in the large-cap funds.

According to me, any overlap above 25-30% will not be a great diversification.

| Security | QUMC | HDMCO | KOEE | PGIMO | SBMM |

| Quant Mid Cap Fund | – | 10% | 5% | 1% | 6% |

| HDFC Mid-Cap Opportunities Fund | 10% | – | 27% | 24% | 19% |

| Kotak Emerging Equity Fund | 5% | 27% | – | 26% | 31% |

| PGIM India Midcap Opportunities Fund | 1% | 24% | 26% | – | 28% |

| SBI Magnum Midcap Fund | 6% | 19% | 31% | 28% | – |

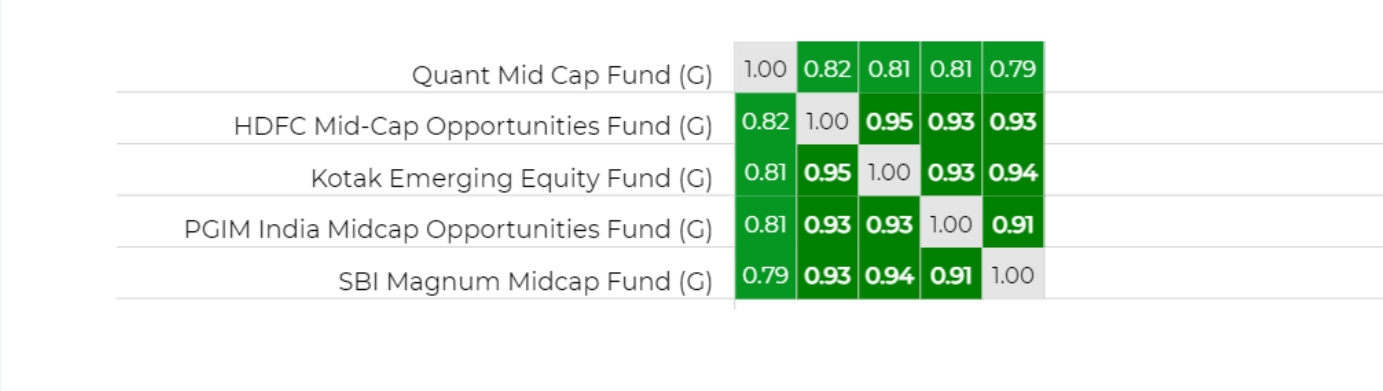

Correlation:

Correlation is another important parameter to look at while constructing a portfolio.

Correlation is nothing but how much of the assets are funds are related to each other in the event of a market up or downside movement.

If you look at the above data, most of the funds are correlated. For most of the equity funds be it large, Mid & Small cap funds the correlation is 0.7 to 0.8.

That is why it is super important to build a portfolio that has diversification and different asset classes which are not correlated to each other.

That is why asset allocation is so crucial. We follow CAPM while constructing a portfolio.

We at Vika Wealth have an in-house mechanism for constructing an asset allocation model, taking not only the above parameters into consideration. But another 8-10 parameters.

Conclusion:

Just looking at past returns is the not only way to look at them while investing. One should understand the nitty gritty of the funds considering more than multiple parameters as we discussed above.

- Jul 8, 2023

Disclaimer: By no means the above names are recommended for investing.

Subscribe To Our Blogs

About Author

Sri Subhash Yerneni

Sri Subhash is an astute banking and finance professional with 14 years of real-world experience in wealth management, advisory of financial instruments such as mutual funds-equity and debt-alternate investment funds ( AIF)-structure and offshore products-private equity-venture capital/debt-bonds and MLDs-priority banking-cash management-team management-and working with various cultures in various nations.

Recent Blogs

Quick Links

Services

Services

Contact Info

Plot No. 104, Usha's The Felicity, Fourth Floor, Road No. 2, Kakatiya Hills, Jubilee Hills, Hyderabad, Telangana 500033

Copyright © 2025 VIKA WEALTH – All Rights Reserved.

Quick Links

Services

Contact Info

Plot No. 104, Usha's The Felicity, Fourth Floor, Road No. 2, Kakatiya Hills, Jubilee Hills, Hyderabad, Telangana 500033

Copyright © 2025 VIKA WEALTH – All Rights Reserved.