Markets Update – Play Test Cricket

The ongoing market correction may be new for recent investors, but experienced participants recognize that such phases, including deeper corrections and extended periods of sideways movement, are part of the market cycle.

This year is unlikely to deliver runaway returns, and investors should temper expectations. We are super confident on India for next 5-10 years as economy because of Demographics, Tech Advancement, Retail Investors and DII’s participation is not even 1/3 of Fixed deposits in the country.

Globally, US-China relations tariffs, and potential currency devaluations could introduce volatility. Domestically, sticky inflation, tight liquidity, and earnings slowdowns present challenges, though India’s long-term growth story remains intact.

How the currency and market reacted to China’s devaluation move?

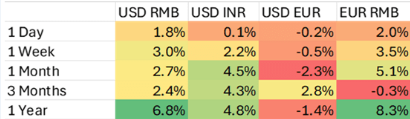

Currency: Post the devaluation move during August 2015 to August 2016, RMB depreciated against USD by ~3-4% within a week but it did not stop there. RMB depreciated further and ended up ~7-8% weaker in a year. However, INR also depreciated and thus, limited the benefit to China’s move.

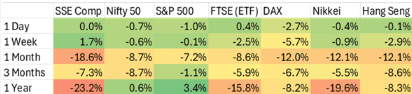

Markets: This led to short-term market fluctuation with most of the global indices seeing volatility over 1-month and 3-months period.

Any moderate move, like the current situation will lead to a sideways market for next few quarters. But the point is we don’t know how it is likely to be. Whatever the direction, it will have implications on the markets.

Trump is known to avoid wars and settle issues. Ongoing geo-conflicts can potentially settle down. If it happens, supply chain issues will be better. However, given the fact US and China has a cold war for supremacy, these issues are always unlikely to settle.

Our View:

- Lower Expectations: Adopt a conservative outlook, as markets may continue to face headwinds.

- Avoid Excessive Risk: Stay cautious, especially with leverage.

- Stay Invested: Timing the market is difficult. Focus on quality funds and companies with strong fundamentals.

- Focus on Resilient Sectors: Banking, Pharma, IT, and Manufacturing are expected to perform well amid current conditions.

- Seize Opportunities Amidst Volatility: Use market dips to invest strategically at lower levels.

This year is about playing “test cricket”—stay patient, wait for the right opportunities, and hit boundaries when bad balls are presented, have long-term view. Do not sit out of markets and try to time the investments.

At Vika wealth, our job is to make you a better-informed investor.

Best Regards

Sri Subhash Yerneni,

Founder,

Vika Wealth.

- Jan 17, 2025

Family Office | Estate Planning | Tax Services | ESOP Advisory | Company Incorporations | Mutual Funds | PMS | Bonds | AIF | Offshore Investing | Private Equity and Venture Capital Funds

Disclaimer: All the above views are for educational purposes and are not given as investment advice.

Subscribe To Our Blogs

About Author

Sri Subhash Yerneni

Sri Subhash is an astute banking and finance professional with 14 years of real-world experience in wealth management, advisory of financial instruments such as mutual funds-equity and debt-alternate investment funds ( AIF)-structure and offshore products-private equity-venture capital/debt-bonds and MLDs-priority banking-cash management-team management-and working with various cultures in various nations.

Recent Blogs

Quick Links

Services

Services

Contact Info

Plot No. 104, Usha's The Felicity, Fourth Floor, Road No. 2, Kakatiya Hills, Jubilee Hills, Hyderabad, Telangana 500033

Copyright © 2025 VIKA WEALTH – All Rights Reserved.

Quick Links

Services

Contact Info

Plot No. 104, Usha's The Felicity, Fourth Floor, Road No. 2, Kakatiya Hills, Jubilee Hills, Hyderabad, Telangana 500033

Copyright © 2025 VIKA WEALTH – All Rights Reserved.