China Market Outlook

Trump’s latest tariff announcement on February 1st has sent jitters through global markets, adding a 10% tariff on Chinese imports alongside new duties on Mexican and Canadian goods (Currently, put on pause for time being). While markets adjust to these developments, our analysis focuses on a deeper challenge facing the Chinese economy: its struggle to shift toward consumer-led growth.

The Savings Paradox

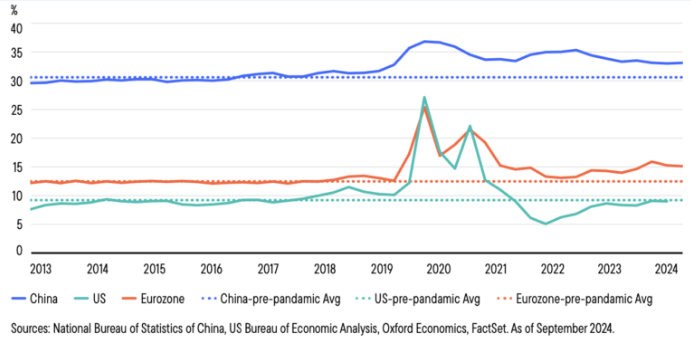

China’s private consumption rate sits at a modest 40% – well below the global average of 58%. This isn’t for lack of wealth, but rather an ingrained tendency toward saving. Chinese households consistently maintain savings rates that dwarf those seen in the US and Eurozone, creating a paradox: the more they save, the harder it becomes to transition to a consumption-driven economy.

Why Are Chinese Consumers Keeping Their Wallets Closed?

The Social Safety Net Gap

Despite China’s economic advances, basic social protections remain inadequate. Uneven retirement benefits, limited healthcare coverage, and high education costs force many to build their own financial safety nets through aggressive saving.

Consumer Confidence Shaken

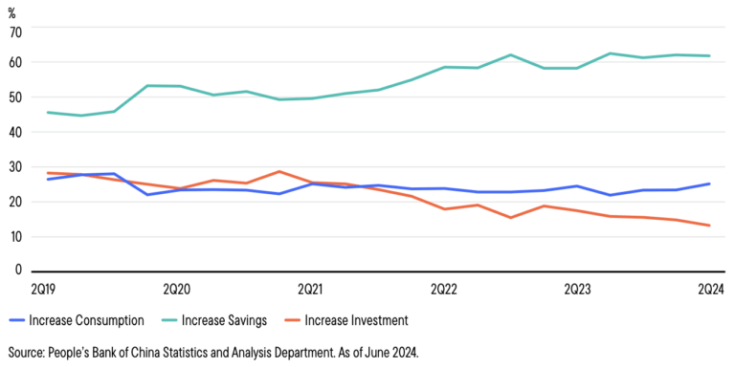

The widespread uncertainty and economic disruption caused by the COVID-19 pandemic led to a sharp drop in consumer confidence and increased precautionary savings. The graph below shows the willingness of Chinese residents to consume, save and invest.

Property Market Decline

The ongoing property market correction that began in 2021 continues to cast a long shadow. With 80% of households owning property and two-thirds of household wealth tied to real estate, declining prices have created a significant wealth effect that’s dampening consumer confidence and hindering private consumption.

The Youth Unemployment Challenge

While the overall unemployment picture has improved since the pandemic peak of 6%, youth unemployment tells a different story. At 17.4% as of September 2024, it represents a concerning trend that is making younger consumers particularly cautious and wary of spending.

The above factors have caused reduced confidence and economic uncertainty amongst citizens. As a result, they prefer to save, in anticipation of an uncertain tomorrow instead of spending today.

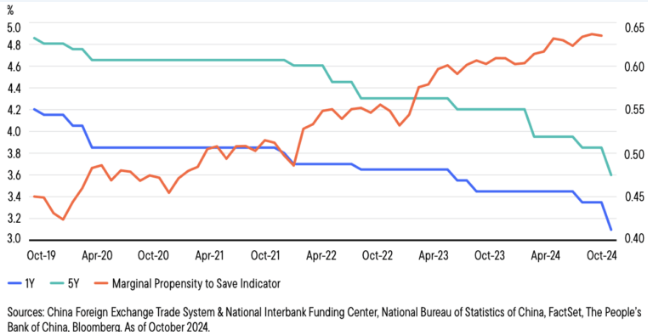

Despite the 1 and 5 year interest rates being cut since 2019, marginal propensity to save has been increasing, as shown in the graph below.

Policy Response: Too Little, Too Late?

Recent policy measures include:

- A 50 basis point cut to reserve requirements

- A 20 basis point reduction in policy rates

- Mortgage rate reductions and lower down payment requirements

However, these traditional monetary tools have shown limited effectiveness in boosting consumer confidence. With Trump’s new tariffs potentially adding to economic headwinds, Chinese policymakers face mounting pressure to coordinate a more comprehensive response.

Conclusion

The success of China’s economic transition hinges on its ability to convince its citizens to spend rather than save. With external pressures mounting from new US tariffs and widespread adoption of ‘China+1’ strategies, the need for effective domestic policy coordination becomes even more critical. We will be watching closely for signs of additional stimulus measures and their impact on consumer confidence in the weeks and months ahead.

We still see tailwinds to the Indian manufacturing sector due to the tariff wars and ‘China+1” policies.

Research Credits: Vishnu Mallipudi

- Feb 7, 2025

Family Office | Estate Planning | Tax Services | ESOP Advisory | Company Incorporations | Mutual Funds | PMS | Bonds | AIF | Offshore Investing | Private Equity and Venture Capital Funds

Disclaimer: All the above views are for educational purposes and are not given as investment advice.

Subscribe To Our Blogs

About Author

Sri Subhash Yerneni

Sri Subhash is an astute banking and finance professional with 14 years of real-world experience in wealth management, advisory of financial instruments such as mutual funds-equity and debt-alternate investment funds ( AIF)-structure and offshore products-private equity-venture capital/debt-bonds and MLDs-priority banking-cash management-team management-and working with various cultures in various nations.

Recent Blogs

Quick Links

Services

Services

Contact Info

Plot No. 104, Usha's The Felicity, Fourth Floor, Road No. 2, Kakatiya Hills, Jubilee Hills, Hyderabad, Telangana 500033

Copyright © 2025 VIKA WEALTH – All Rights Reserved.

Quick Links

Services

Contact Info

Plot No. 104, Usha's The Felicity, Fourth Floor, Road No. 2, Kakatiya Hills, Jubilee Hills, Hyderabad, Telangana 500033

Copyright © 2025 VIKA WEALTH – All Rights Reserved.