Indian Equity Markets – Are They Fairly Valued Now?

For the first time in 29 years, Nifty has experienced a fifth consecutive monthly decline as valuation concerns persist. This marks the first significant correction for many investors who entered the market during COVID, causing widespread anxiety among retail investors.

Having seen multiple market cycles over our years of experience, we anticipated this correction and have been strategically positioning for it.

Opportunity in Volatility

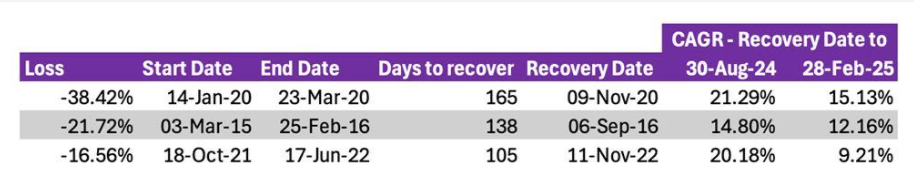

Significant corrections like the current one present excellent opportunities to rebalance portfolios and acquire quality companies at reasonable valuations. Historical data shows strong market recoveries following such corrections.

The table below illustrates three of the largest Nifty 50 drawdowns and their recovery periods.

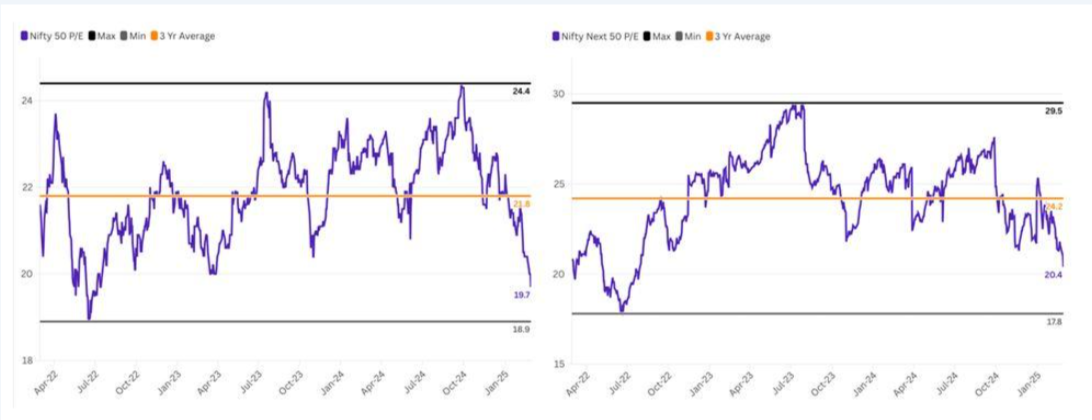

Valuations – Trailing PE

In the above chart of Nifty 50’s trailing PE for the past three years, the average is 21.8 and the PE as on 28th February, 2025 is 19.7, which is trading around 10% discount to the mean. Similarly, Nifty Next 50 is trading at 15% discount to the mean.

Choice of stocks and fund managers will be the critical factor in generating risk-adjusted alpha.

In the above chart of Nifty Midcap 150’s trailing PE for the past three years, the average is 30.3 and the PE as on 28th February, 2025 is 33.4, which is trading around 10% premium to the mean. Similarly, Nifty Smallcap 250 is trading at 5% premium to the mean.

We feel one must still be careful entering into small and midcap. Strategic calls must be taken, with regards to the stocks or the fund managers chosen.

Our Forward Outlook

Recalling our yearly outlook from January, we emphasized approaching markets like test cricket—waiting patiently and striking when opportunities emerge.

After the correction, we are now seeing opportunities arising in few market segments. Rather than waiting for the market to bottom out, this is the time to start nibbling in.

The market has already priced in both domestic and international negative news. While we expect some earnings caution to persist over the next two quarters, conditions should improve compared to recent performance, as the base is low.

Following disappointing earnings results in the past two quarters, we project earnings growth to drive market appreciation over the next three years.

Source: WhiteOak AMC

As seen above, market returns are a slave of earnings.

Conclusion

We remind investors of Warren Buffett’s timeless wisdom:

“Be greedy when others are fearful and be fearful when others are greedy”

Investors currently find themselves in a climate of fear—precisely the moment to accelerate investment activity and actively seek opportunities. India remains firmly on its growth trajectory.

This correction represents merely a temporary slowdown rather than a structural shift. Structurally, we see no fundamental struggles in the Indian economy. We urge investors to continue their SIPs.

For those who are underexposed to the equity markets, this is the perfect time to start allocating capital to the Indian equity markets, as certain market pockets have reached fair valuations.

Research Credits: Subhash

Best Regards

Sri Subhash Yerneni,

Founder,

Vika Wealth.

- Mar 3, 2025

Family Office | Estate Planning | Tax Services | ESOP Advisory | Company Incorporations | Mutual Funds | PMS | Bonds | AIF | Offshore Investing | Private Equity and Venture Capital Funds

Disclaimer: All the above views are for educational purposes and are not given as investment advice.

Subscribe To Our Blogs

About Author

Sri Subhash Yerneni

Sri Subhash is an astute banking and finance professional with 14 years of real-world experience in wealth management, advisory of financial instruments such as mutual funds-equity and debt-alternate investment funds ( AIF)-structure and offshore products-private equity-venture capital/debt-bonds and MLDs-priority banking-cash management-team management-and working with various cultures in various nations.

Recent Blogs

Quick Links

Services

Services

Contact Info

3rd Floor, Plot No. 55/A, Rd No 52, BNR Hills, Jubilee Hills, Rai Durg, Hyderabad - 500081

Copyright © 2025 VIKA WEALTH – All Rights Reserved.

Quick Links

Services

Contact Info

3rd Floor, Plot No. 55/A, Rd No 52, BNR Hills, Jubilee Hills, Rai Durg, Hyderabad - 500081

Copyright © 2025 VIKA WEALTH – All Rights Reserved.