Should You Worry About The Market Fall?

Markets have recently been as fierce as the bear in the picture. As the old Wall Street saying goes:

“Markets take the stairs up and the elevator down.”

This phrase reflects how slow and steady rallies often give way to sharp, sudden declines — and that’s exactly what we’ve witnessed. While the buy-and-hold strategy works over the long term, it’s not a one-size-fits-all approach for every phase of the market.

We began recommending profit booking from the 25,000 Nifty level, especially for portfolios heavily tilted towards small caps, due to:

- Elevated valuations

- Global geopolitical tensions and wars

- Earnings misses

- And overall portfolio misalignment

Understandably, many investors are concerned by the pace and magnitude of the recent decline. So, what should you do next?

The Bigger Picture: Stay Calm, Stay Rational

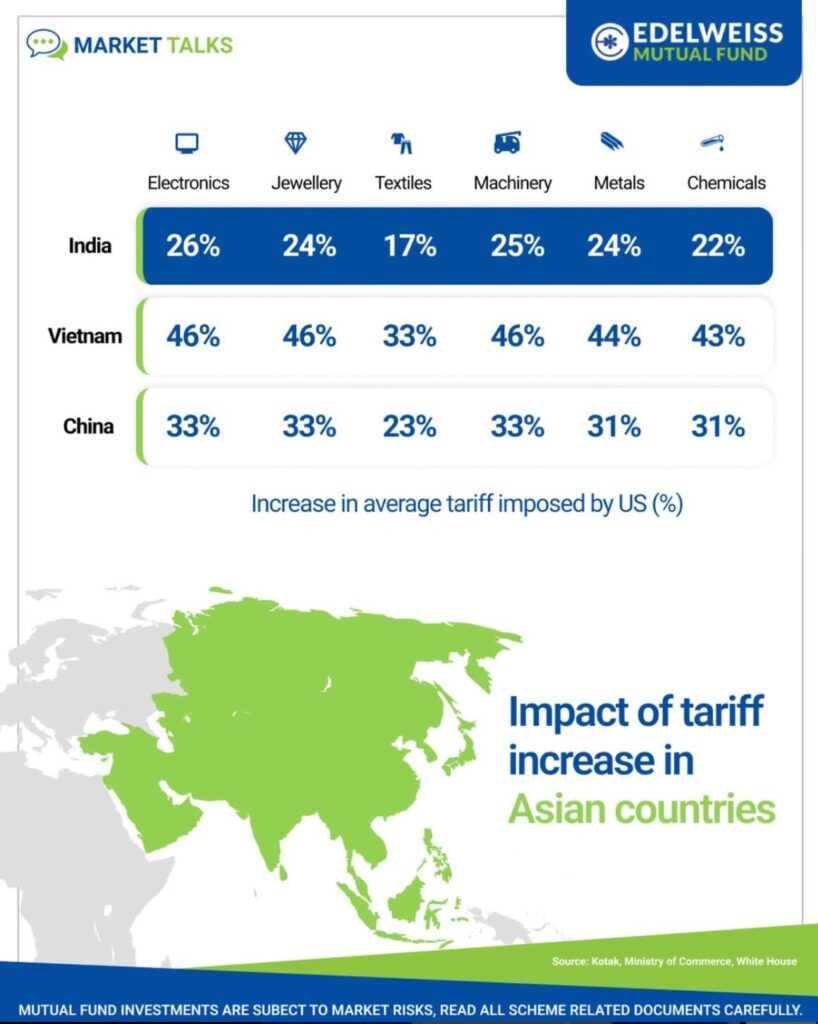

Short-term headwinds like tariffs may lead to supply-side constraints, but it’s important to remember:

- The U.S. accounts for just ~18% of India’s exports.

- It’s not the end of the world.

- In fact, some sectors like textiles and chemicals may benefit from global tariff realignments, thanks to India’s rising competitiveness.

Why India Still Shines: A Fundamental View

As global dynamics shift, India is on the cusp of a transformative economic journey. Unlike China’s export-led ascent, India’s rise is rooted in domestic consumption, democratic resilience, and a youthful population.

Here are 3 key structural drivers we believe will propel Indian markets forward:

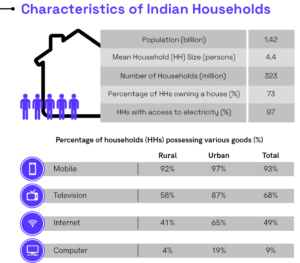

- Domestic driven consumption:

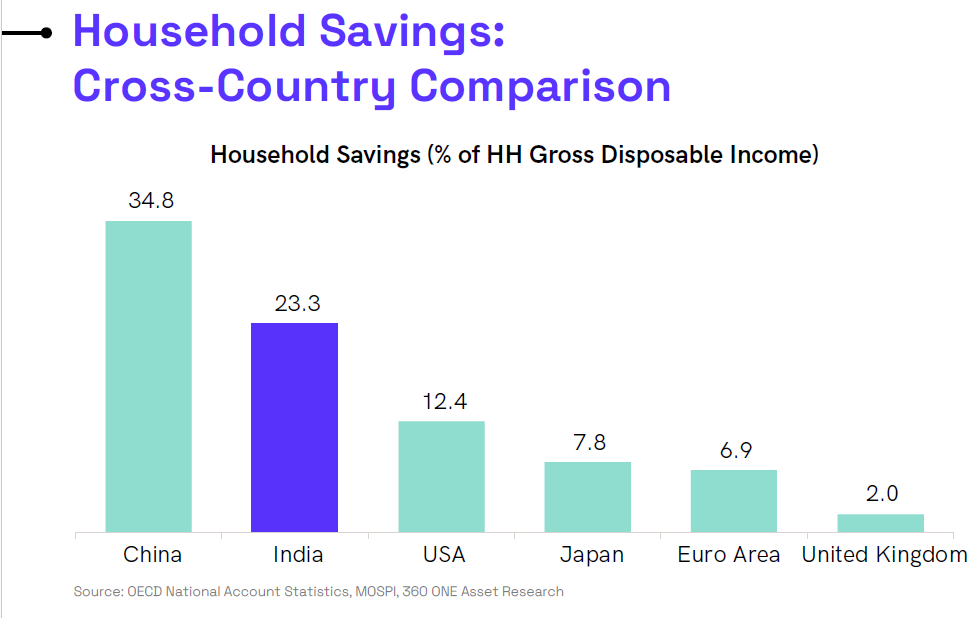

India has one of the highest household savings rates globally.

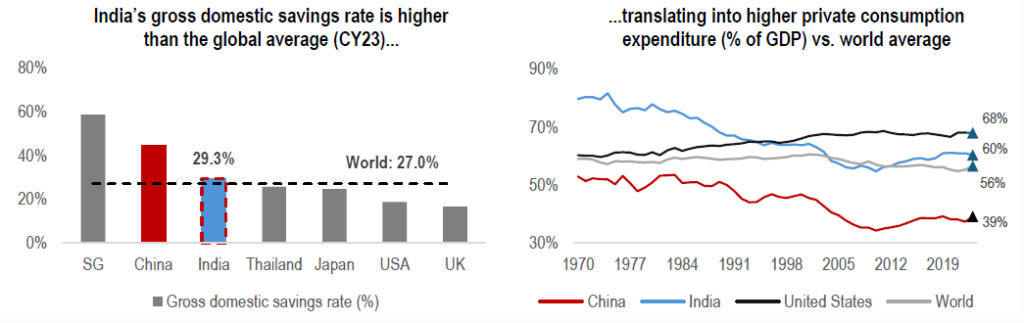

Private consumption, accounting for nearly 60% of GDP, will continue to drive economic expansion. This is in stark contrast to China, where household consumption comprises less than 40% of GDP, reflecting the relative underdevelopment of the consumption sector.

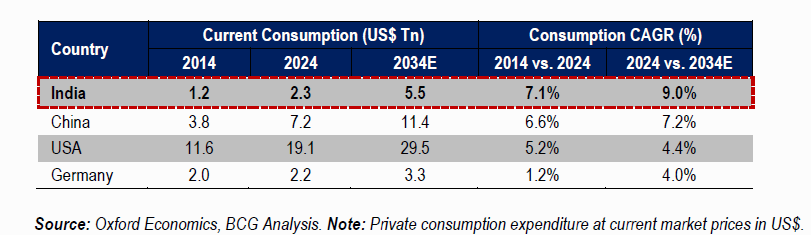

India to witness the highest growth in consumption over the next decade. India’s consumption growth trajectory has been secular and is expected to significantly outpace other major economies, with CAGR growth of 9% (between 2024-34E), followed by China at 7.2% and the US at 4.4%.

Do you know? On what Indian consumers spend more money on?

It is food which is 30% (Per capita Consumption Expenditure) - Govt capex and Infra Development:

Thanks to robust GST collections, government spending on infrastructure has surged.

We are seeing:

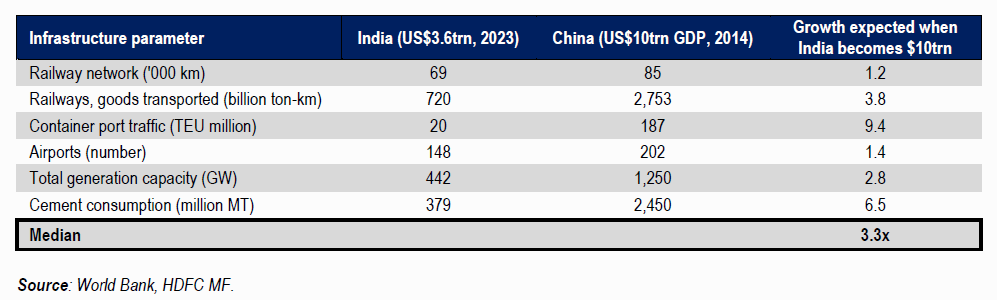

• Faster road and railway construction

• Development of airports

• Increased focus on logistics and connectivity

This will have a multiplier effect across sectors and employment.

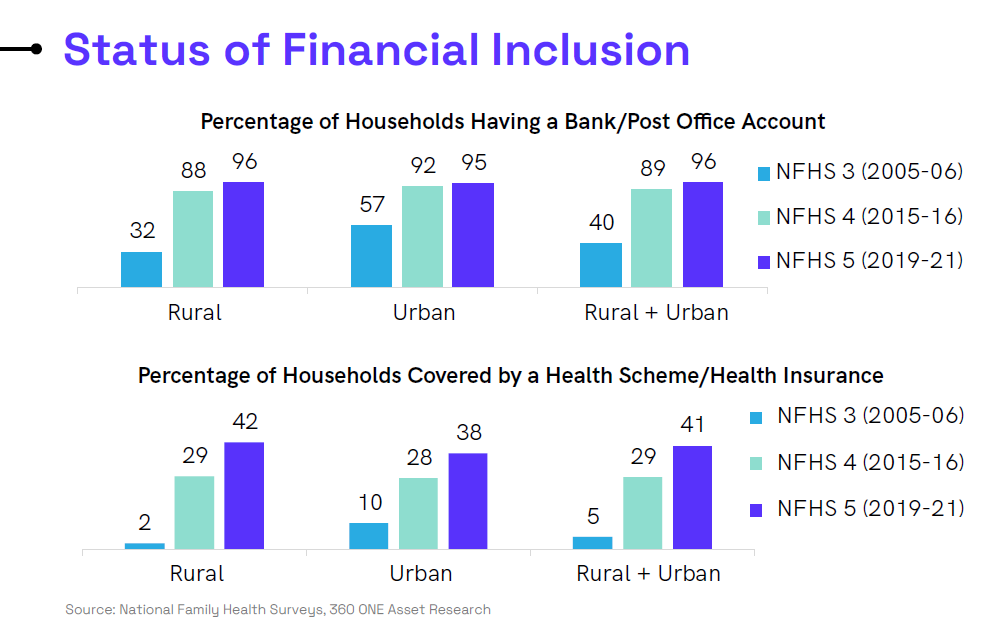

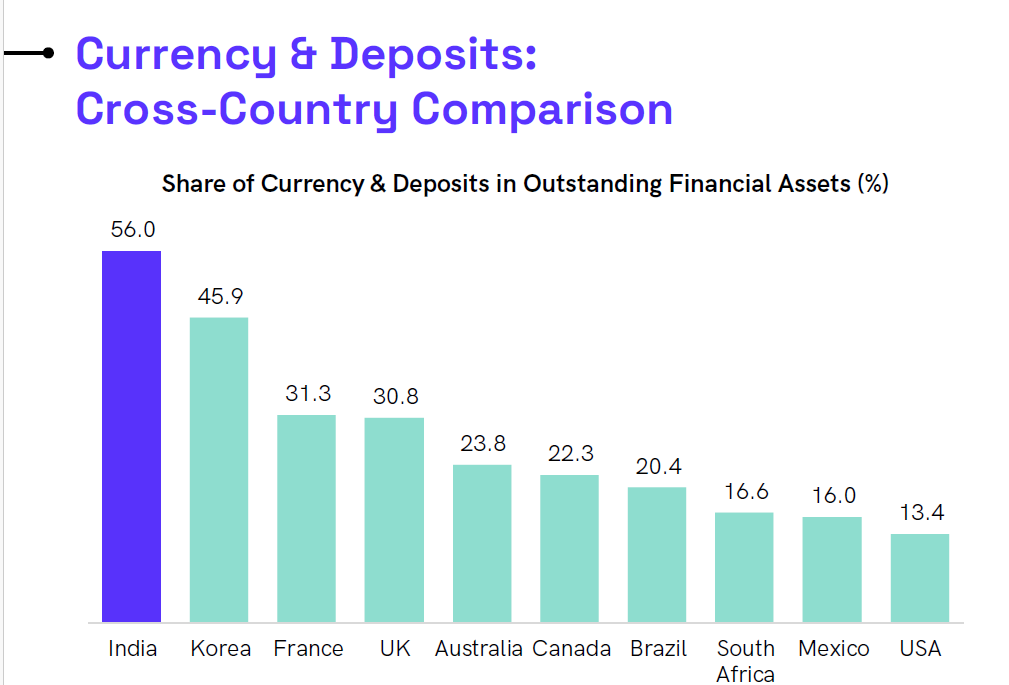

- Financial Inclusion & Equity Participation:Over 98% of the population now has access to a bank or post office account, significantly reducing leakages in government welfare schemes and increasing household participation in formal financial systems.

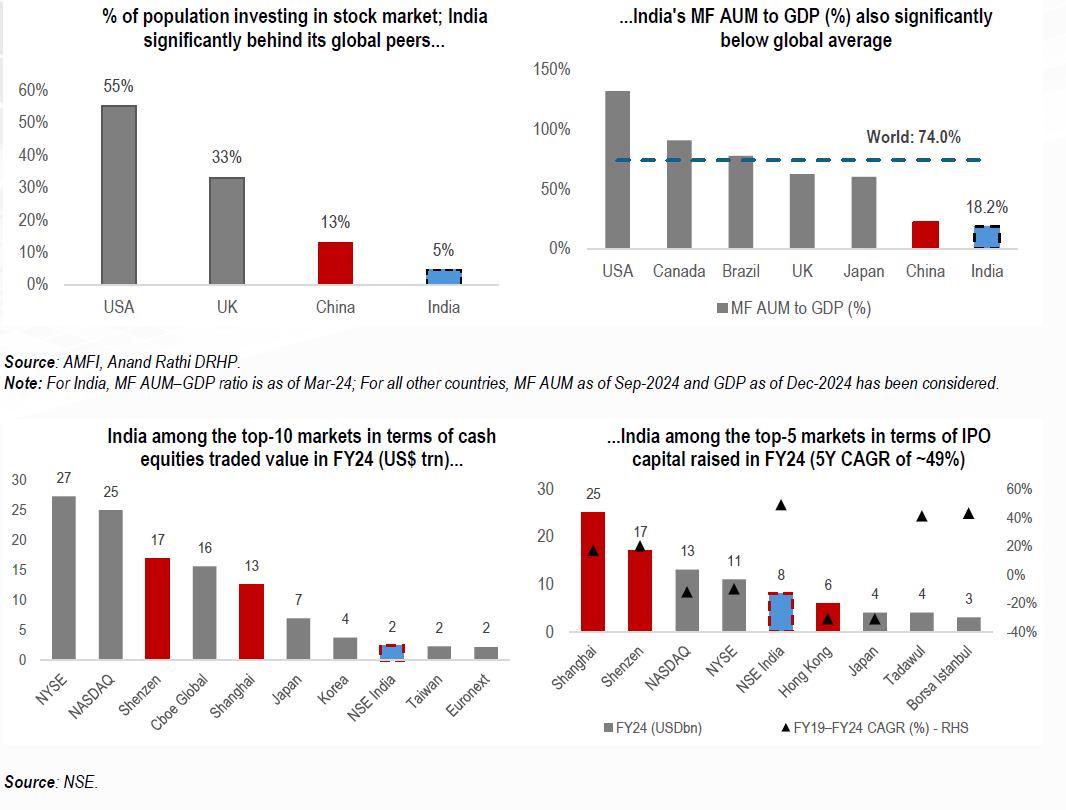

Yet, India remains underpenetrated in equity ownership relative to global peers. This gap presents a meaningful opportunity:

• As trust in markets builds,

• And digital platforms simplify access to investment products,

• We expect broader retail participation in equities to continue rising

Conclusion: Be Disciplined, Be Patient — Tune Out the Noise

India’s structural growth story is far from over. While short-term corrections can be uncomfortable, they are also healthy and often necessary to reset expectations and valuations. This is not the time to panic — it is a time to review allocations, reaffirm long-term objectives, and avoid reactionary decisions driven by noise.

Unlike China’s export-led and centrally managed growth, India’s path is one of democratic, domestic-led expansion — powered by consumption, infrastructure, and digital inclusion.

As global growth becomes more multi-polar, India is not just participating — it is positioning itself as a pivotal player in shaping the world’s economic future.

Long-term investors who stay the course, stay diversified, and stay focused on quality will be best positioned to benefit from this transformation.

- Apr 8, 2025

Family Office | Estate Planning | Tax Services | ESOP Advisory | Company Incorporations | Mutual Funds | PMS | Bonds | AIF | Offshore Investing | Private Equity and Venture Capital Funds

Disclaimer: All the above views are for educational purposes and are not given as investment advice.

Subscribe To Our Blogs

About Author

Sri Subhash Yerneni

Sri Subhash is an astute banking and finance professional with 14 years of real-world experience in wealth management, advisory of financial instruments such as mutual funds-equity and debt-alternate investment funds ( AIF)-structure and offshore products-private equity-venture capital/debt-bonds and MLDs-priority banking-cash management-team management-and working with various cultures in various nations.

Recent Blogs

Quick Links

Services

Services

Contact Info

3rd Floor, Plot No. 55/A, Rd No 52, BNR Hills, Jubilee Hills, Rai Durg, Hyderabad - 500081

Copyright © 2025 VIKA WEALTH – All Rights Reserved.

Quick Links

Services

Contact Info

3rd Floor, Plot No. 55/A, Rd No 52, BNR Hills, Jubilee Hills, Rai Durg, Hyderabad - 500081

Copyright © 2025 VIKA WEALTH – All Rights Reserved.