Property Buying – Home Loan vs Down Payment

While deciding on buying a property, it is critical to strike a balance between asset acquisition and long-term wealth creation. The following structured methodology ensures financial prudence and growth-oriented decision-making:

Step-by-Step Framework for Property Financing

- Evaluate Financial Position

- Savings Analysis: Determining one’s liquid assets and savings available for the property transaction.

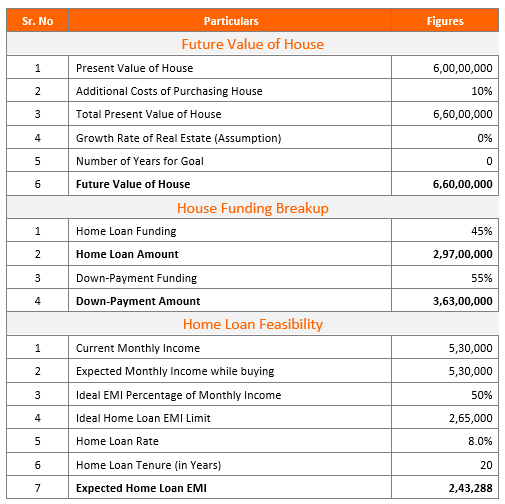

- Example: An individual has ₹6 crores in savings and is looking to purchase a property valued at ₹7 crores.

- Assess Income Stability and EMI Affordability

- Review the family’s net monthly income to estimate a manageable EMI.

- Best Practice: Limit the EMI to no more than 30-50% of the family’s monthly net income to maintain liquidity and financial stability.

- Optimize Down Payment and Loan Allocation

- Avoid exhausting savings on a full cash purchase. Leverage a home loan at competitive interest rates (e.g., 8% for 20 years) to retain capital for investments.

- Example Allocation:

- ₹3 Cr: Down payment towards the property.

- ₹4 Cr: Home loan to finance the remaining amount.

- Diversify Investment Portfolio

- Allocate surplus savings (e.g., ₹3-4 Cr) to investment avenues with the potential for higher, non-correlated returns.

- Suggested portfolio mix: Mutual funds, AIFs, international equities, or other structured products tailored to the client’s risk profile.

- Analyze Opportunity Cost

- Example Insight:

- Nifty 50 mutual funds have delivered an average return of 15% over the last 25 years.

- A loan at 8% creates an arbitrage opportunity: Investments targeting 14-16% annualized returns can significantly enhance overall portfolio value over time.

- These returns could support future goals like children’s education, weddings, or retirement.

Given an interest rate of 8%, the total interest paid by the end of 20 years will be nearly 3 crores.

If you set aside 1 lakh from your monthly income to be invested in a monthly SIP, assuming an XIRR of 15% over 20 years would yield over 13.3 crores.

Key Takeaways

- Invest Surplus Savings: Diversifying investments rather than committing excess funds to the EMIs often results in greater returns.

- Leverage Favourable Loan Rates: Long-term home loan rates remain attractive, making borrowing more effective for wealth strategy.

- Personalized Analysis: A clear understanding of your financial health and goals guides optimal allocation between property funding and investment.

Conclusion

Rather than making emotional or impulsive decisions, it is crucial to adopt a logical and balanced approach when allocating resources.

At VIKA Wealth, we aim to provide a 360-degree view, guiding families through critical decisions that impact their financial health and growth. We work collaboratively to ensure:

- Optimized Investment Strategies: Allocating funds to diversified, high-potential instruments.

- Tax Efficiency: Structuring portfolios and financial plans to minimize tax liabilities.

- Smart Borrowing Decisions: Advising on home loan vs. down payment strategies that maximize liquidity and create wealth.

- Rent vs. Buy Analysis: Helping clients evaluate whether renting or buying aligns better with their financial and lifestyle goals.

- Family-Centric Planning: Tailoring solutions for key life goals such as children’s education, marriage, retirement, and wealth preservation.

We are not just investment managers; we are financial partners who handhold our clients through every critical decision. Our goal is to empower families to make informed, strategic choices that balance short-term needs with long-term aspirations.

Research Credits: Vishnu Mallipudi

Best Regards

Sri Subhash Yerneni,

Founder,

Vika Wealth.

- August 6, 2025

Family Office | Estate Planning | Tax Services | ESOP Advisory | Company Incorporations | Mutual Funds | PMS | Bonds | AIF | Offshore Investing | Private Equity and Venture Capital Funds

Disclaimer: All the above views are for educational purposes and are not given as investment advice.

Subscribe To Our Blogs

About Author

Sri Subhash Yerneni

Sri Subhash is an astute banking and finance professional with 14 years of real-world experience in wealth management, advisory of financial instruments such as mutual funds-equity and debt-alternate investment funds ( AIF)-structure and offshore products-private equity-venture capital/debt-bonds and MLDs-priority banking-cash management-team management-and working with various cultures in various nations.

Recent Blogs

Quick Links

Services

Services

Contact Info

3rd Floor, Plot No. 55/A, Rd No 52, BNR Hills, Jubilee Hills, Rai Durg, Hyderabad - 500081

Copyright © 2025 VIKA WEALTH – All Rights Reserved.

Quick Links

Services

Contact Info

3rd Floor, Plot No. 55/A, Rd No 52, BNR Hills, Jubilee Hills, Rai Durg, Hyderabad - 500081

Copyright © 2025 VIKA WEALTH – All Rights Reserved.