Dubai Real Estate 2025 : Investment Opportunities and Market Outlook

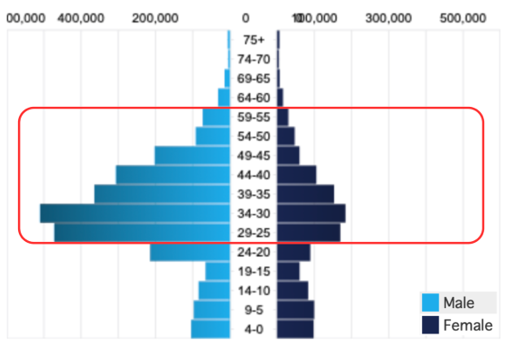

Dubai’s population has more than doubled in the past 14 years, surpassing the 4 million mark in 2025. Population projections indicate Dubai could reach 5.5 to 6 million residents by 2030. Over 90% of the population consists of expatriates migrating to Dubai. Is there an opportunity in this?

Source: Dubai Data and Statistics Centre via DXB Interact

In recent years, Dubai has turned into an attractive destination for living, working and investing. The unique blend of economic, social, and lifestyle advantages offered by Dubai attracts thousands of foreigners each year. Dubai, and UAE in general, have no border conflicts with neighboring countries. Its political stability and strategic location amidst global hubs also offer key advantages.

Why are people turning to Dubai?

Economic and Career Opportunities: Dubai has a diversified economy with rapid job creation across technology, finance, tourism, logistics, and trade. Favorable business regulations, taxation and work environment lead to robust GDP growth and career advancement.

Tax and Financial Benefits: Individuals enjoy a tax-free salary, no capital gains tax, and no property tax—making it a major consideration for high-net-worth individuals, entrepreneurs, and investors.

Quality of Life and Infrastructure: Dubai offers world-class infrastructure, public services, healthcare, education, and transportation. The city is renowned for its safety and very low crime rates.

Immigration and Demographics: Progressive residency policies, such as the Golden Visa and business/investor visas, make it easier for skilled individuals and investors to relocate and settle long-term.

Real Estate and Investment Climate: Growing demand from a rising population and constant infrastructure investment supports capital appreciation and income returns.

Dubai Real Estate

Dubai’s population growth represents the most compelling factor supporting long-term real estate demand. Dubai’s population is expected to grow at 4-5% annually for the next 5 years, creating sustained housing demand that significantly outpaces supply delivery. The population demographic is also favorable towards raising housing demand, with 72% of the population in the 25–59-year age range.

Source: Dubai Data and Statistics Centre

Off-Plan vs Ready Properties

In Dubai real estate, whether it is for residential or commercial purpose, we come across two kinds of projects: Off-plan and Ready. ‘Off-plan’ refers to properties that are still under construction or in the planning stage, while ‘ready’ properties are completed and available for immediate occupancy or resale.

Off-Plan Properties

- Buyers invest before construction is complete, often at a lower price.

- Payment plans are usually spread over the construction period.

- Potential for capital appreciation as the project progresses.

- Risks include construction delays or changes in market conditions.

- Attracts investors looking for new developments and modern amenities.

Ready Properties

- Completed and available for immediate occupancy or rental.

- Buyers can see the exact condition before purchase.

- Easier to finance and get mortgage approval.

- Generates immediate rental income or used for personal use.

- Typically, priced higher than off-plan due to lower risk and availability.

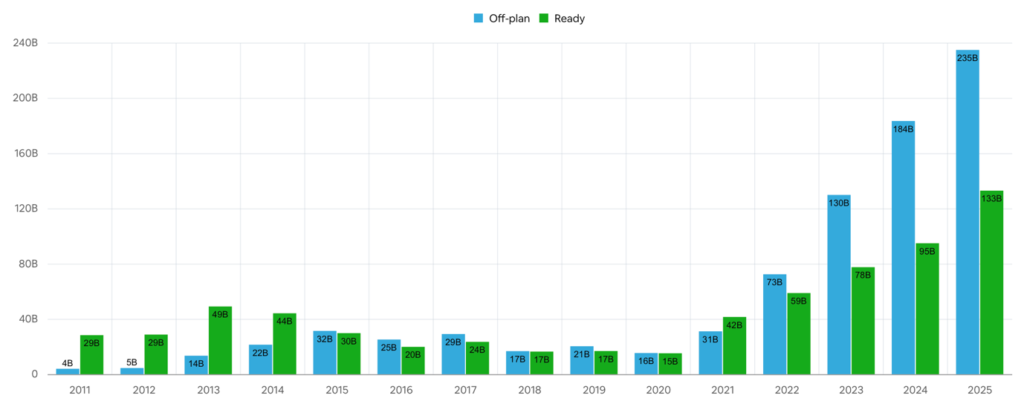

Volume of Property Sales

Value of Property Sales (in AED)

Source: DXB Interact; Data as of August 2025

Off-plan sales have grown significantly in Dubai due to ongoing mega projects and infrastructure development. They offer better long-term appreciation if the project is in a high-demand area. Flexibility in payment plans and lower entry points make off-plan projects better for investors.

Rental Yields

Gross rental yields of 7.3% for apartments and 5.0% for villas are among the world’s highest. Prime office spaces in DIFC and Downtown Dubai provide 7-10% annual returns.

The tables below show the rental yields in key communities across Dubai.

Source: Engel & Völkers

Regulatory and Legal Landscape

Dubai’s real estate sector has undergone substantial regulatory and legal updates in 2025 alone. These updates are designed to strengthen investor protection, simplify processes, and boost global confidence. Developers are required to place funds in RERA-approved escrow accounts, ensuring that payments are only released as construction milestones are achieved, thereby reducing the risk of project delays or non-completion.

Property registration, documentation, and most transactional processes have moved online. Both initial registration and title transfer can be completed digitally, reducing paperwork and increasing efficiency.

Is the Market at Its Peak?

The Dubai real estate market has been on an incredible rally for the past five years. Property prices and sales volumes have reached record highs in 2025. This makes us question if the market is at its peak and heading towards a downturn.

Forecasts predict that anywhere between 150,000 and 250,000 new homes will be delivered from 2025 to 2027. With this high level of supply and record high prices, demand is expected to cool down slightly.

A 10-15% price correction in the market is expected over the next two years. High-end villas and apartments in prime locations are expected to retain value, while the correction would likely be restricted to outer-city areas and mid-market properties. One should aim to invest with reputed builders and in prime locations.

Conclusion

While Dubai real estate market is close to its short-term peak, strong fundamentals and demand drivers position it for sustained long-term growth. Rental yields are amongst the highest in the world.

For investors, the next five years represent a strategic opportunity to capitalize on infrastructure-driven growth, demographic expansion, and Dubai’s transformation into a global business and lifestyle hub.

Research Credits: Vishnu Mallipudi

Best Regards

Sri Subhash Yerneni,

Founder,

Vika Wealth.

- October 06, 2025

Family Office | Estate Planning | Tax Services | ESOP Advisory | Company Incorporations | Mutual Funds | PMS | Bonds | AIF | Offshore Investing | Private Equity and Venture Capital Funds

Disclaimer: All the above views are for educational purposes and are not given as investment advice.

Subscribe To Our Blogs

About Author

Sri Subhash Yerneni

Sri Subhash is an astute banking and finance professional with 14 years of real-world experience in wealth management, advisory of financial instruments such as mutual funds-equity and debt-alternate investment funds ( AIF)-structure and offshore products-private equity-venture capital/debt-bonds and MLDs-priority banking-cash management-team management-and working with various cultures in various nations.

Recent Blogs

Quick Links

Services

Services

Contact Info

3rd Floor, Plot No. 55/A, Rd No 52, BNR Hills, Jubilee Hills, Rai Durg, Hyderabad - 500081

Copyright © 2025 VIKA WEALTH – All Rights Reserved.

Quick Links

Services

Contact Info

3rd Floor, Plot No. 55/A, Rd No 52, BNR Hills, Jubilee Hills, Rai Durg, Hyderabad - 500081

Copyright © 2025 VIKA WEALTH – All Rights Reserved.