Multi-Asset Funds: The All-Rounders Every Portfolio Needs

Every successful cricket team has that one dependable all-rounder, the kind of player who can steady the innings when wickets are tumbling and also accelerate when the team needs runs. They may not always grab headlines, but they’re often the reason a team wins tough matches.

In investing, multi-asset allocation funds play exactly that role. They are the all-rounders of your portfolio – flexible, balanced, and dependable.

Think of equity as your aggressive batsman – capable of big runs, but also vulnerable to market swings. Debt acts like your solid defensive player – not flashy, but steady and reliable when conditions get tough. And gold or silver? That’s your brilliant fielder – not always in the spotlight, but crucial when it comes to saving the match during turbulent times.

What makes multi-asset funds special is how they bring these three elements together in perfect balance. When equity markets rally, they score runs. When volatility spikes, their debt and gold components step in to protect the portfolio – just like an all-rounder switching roles based on match conditions.

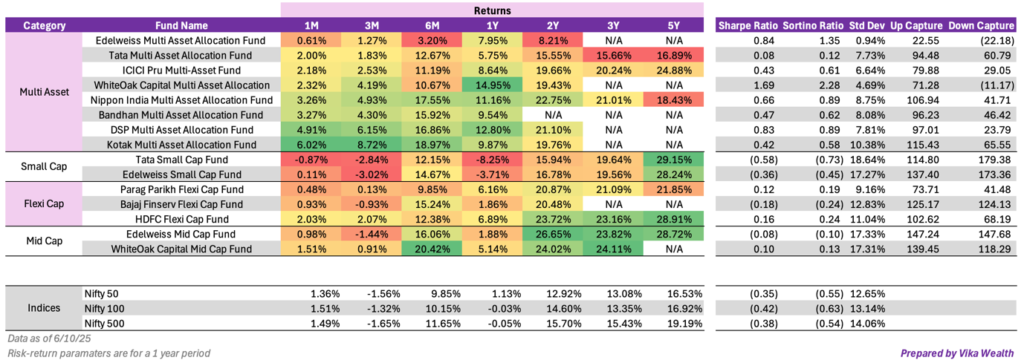

The last two years have been a great reminder of this. Multi-asset funds have quietly delivered strong, risk-adjusted returns, outperforming indices while keeping volatility under control – proving once again that consistency often beats aggression.

Just as a good captain knows when to send in the all-rounder, investors too must know how to give the right weightage to this category. For those aiming for steady long-term performance with controlled risk, multi-asset funds deserve a permanent spot in the playing XI of your portfolio.

At Vika Wealth, we help you use multi-asset funds to bring balance and consistency to your investment game.

Best Regards

Sri Subhash Yerneni,

Founder,

Vika Wealth.

- October 07, 2025

Family Office | Estate Planning | Tax Services | ESOP Advisory | Company Incorporations | Mutual Funds | PMS | Bonds | AIF | Offshore Investing | Private Equity and Venture Capital Funds

Disclaimer: All the above views are for educational purposes and are not given as investment advice.

Subscribe To Our Blogs

About Author

Sri Subhash Yerneni

Sri Subhash is an astute banking and finance professional with 14 years of real-world experience in wealth management, advisory of financial instruments such as mutual funds-equity and debt-alternate investment funds ( AIF)-structure and offshore products-private equity-venture capital/debt-bonds and MLDs-priority banking-cash management-team management-and working with various cultures in various nations.

Recent Blogs

Quick Links

Services

Services

Contact Info

3rd Floor, Plot No. 55/A, Rd No 52, BNR Hills, Jubilee Hills, Rai Durg, Hyderabad - 500081

Copyright © 2025 VIKA WEALTH – All Rights Reserved.

Quick Links

Services

Contact Info

3rd Floor, Plot No. 55/A, Rd No 52, BNR Hills, Jubilee Hills, Rai Durg, Hyderabad - 500081

Copyright © 2025 VIKA WEALTH – All Rights Reserved.