Diversification Beyond Numbers: A Risk-First Perspective

Missing The Bigger Picture

Investment decisions by busy professionals are usually made in fragments, aimed at tax benefits, market rallies, or the receipt of bonuses. While the ends absolutely make sense, what often lacks in this process is the integration which ties them to the long-term goals of the investor. This results in improper diversification.

Professionals frequently evaluate investments in isolation. They ask if a particular product is good rather than asking, “What does this add to my portfolio?” The result is hidden concentration across assets that appear unrelated but are driven by similar economic forces.

When markets turn volatile, such portfolios reveal the uncomfortable truth that risk was never truly diversified, leaving them vulnerable to the downside.

This underscores the importance of diversification in terms of quality rather than quantity.

Understanding Diversification

Diversification is one of the most misunderstood concepts in investing. As a concept, it is fairly simple, where the idea is to spread risk across different asset classes so that no single outcome dominates your financial future. In practice, many investors equate diversification with the number of products they own. This results in portfolios cluttered with schemes, funds, policies, and instruments that appear diversified on the surface but behave similarly when it matters most.

True diversification is not about quantity, but rather about differences in risk drivers, economic sensitivity, cash flow behaviour, and response to uncertainty.

The Illusion of Diversification

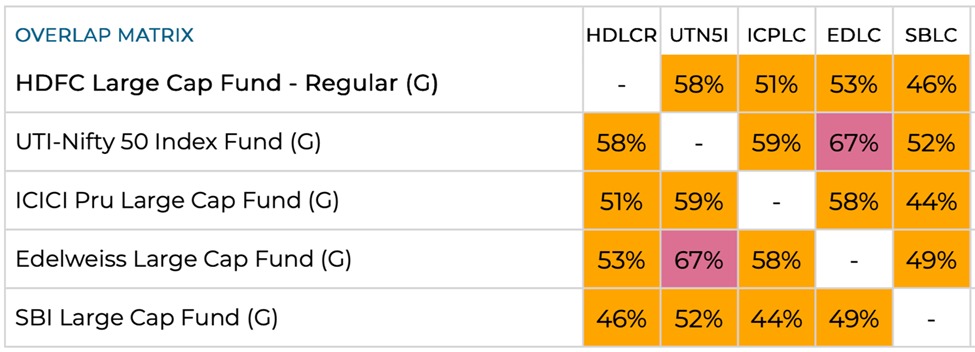

Many products are exposed to the same underlying risks, even if they are packaged differently. A large-cap fund, a blue-chip fund, and a NIFTY-50 index fund are all driven mostly by the same stocks, market sentiments, liquidity conditions, and earnings cycles. Adding more of them increases complexity, not diversification. The matrix below shows how there is ~50% overlap in constituents across all the funds listed.

Ironically, excessive diversification often increases behavioural risk, the very risk diversification is supposed to reduce.

Diversification Is More About Risk Than Return

Meaningful diversification begins by identifying the dominant risk factors in a portfolio, such as:

- Equity market risk

- Liquidity risk

- Inflation risk

- Behavioural risk

Owning ten products that are all sensitive to the same two or three factors does little to reduce portfolio vulnerability. It merely spreads capital thinner across similar outcomes.

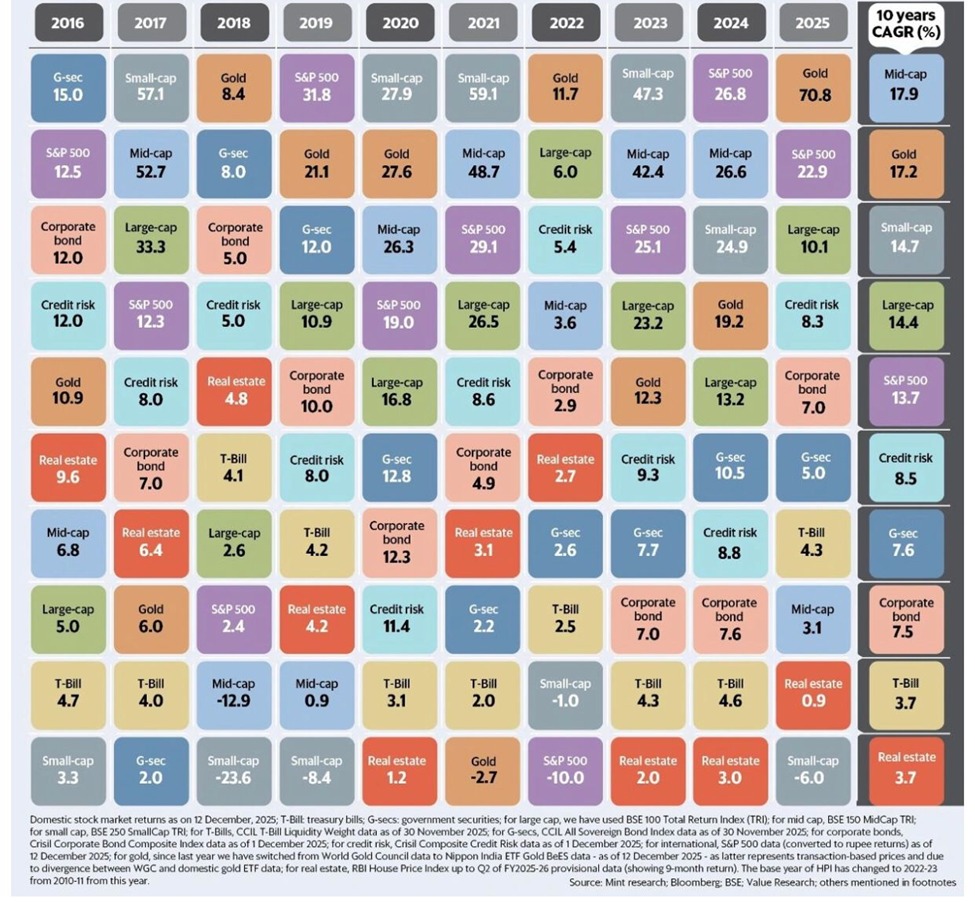

A well-diversified portfolio, by contrast, holds assets that respond differently to economic environments. Some benefit from growth, some provide stability during times of stress, and others offer protection, all while keeping the investor’s overarching needs in mind. The table below shows how asset classes go through cycles, which leads to a rotation in the best performers each year.

Correlation Reveals the Truth

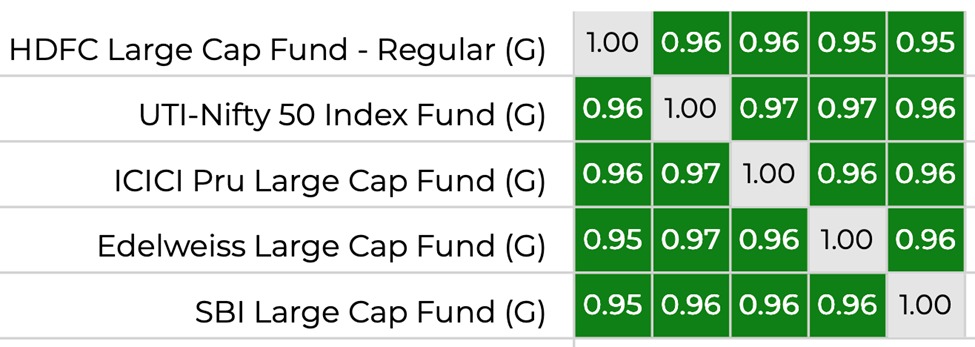

Diversification only works when correlations act inversely during stress. Portfolios that look diversified because they hold many products often show high correlation precisely when protection is needed most. In the portfolio below, we see high positive correlation between the funds. In case of a market downturn, the entire portfolio takes a beating. This is not a flaw of the markets, but a flaw of construction.

True diversification accepts that:

- Some assets will underperform at all times

- Some positions exist primarily to protect, not outperform

- Discomfort is part of the long game.

Conclusion

Fewer products, chosen deliberately for their role, are easier to manage, rebalance, and stay committed to. Clarity beats complexity. Structure beats accumulation.

A well-constructed portfolio does not aim to own everything. It aims to own what is necessary.

Research Credits: Pranay Tippavajhala

Best Regards

Sri Subhash Yerneni,

Founder,

Vika Wealth.

- December 26, 2025

Family Office | Estate Planning | Tax Services | ESOP Advisory | Company Incorporations | Mutual Funds | PMS | Bonds | AIF | Offshore Investing | Private Equity and Venture Capital Funds

Disclaimer: All the above views are for educational purposes and are not given as investment advice.

Subscribe To Our Blogs

About Author

Sri Subhash Yerneni

Sri Subhash is an astute banking and finance professional with 14 years of real-world experience in wealth management, advisory of financial instruments such as mutual funds-equity and debt-alternate investment funds ( AIF)-structure and offshore products-private equity-venture capital/debt-bonds and MLDs-priority banking-cash management-team management-and working with various cultures in various nations.

Recent Blogs

Quick Links

Services

Services

Contact Info

3rd Floor, Plot No. 55/A, Rd No 52, BNR Hills, Jubilee Hills, Rai Durg, Hyderabad - 500081

Copyright © 2025 VIKA WEALTH – All Rights Reserved.

Quick Links

Services

Contact Info

3rd Floor, Plot No. 55/A, Rd No 52, BNR Hills, Jubilee Hills, Rai Durg, Hyderabad - 500081

Copyright © 2025 VIKA WEALTH – All Rights Reserved.